Nvidia’s stock has surged due to its strong leadership in the AI sector, particularly in AI chip technology. The company’s GPUs are highly sought after for AI applications, leading to significant financial success, as evidenced by a 262% year-over-year revenue increase in its fiscal first quarter. This has bolstered investor confidence and led to positive analyst outlooks, further driving the stock price upward. Market enthusiasm for AI’s transformative potential, combined with Nvidia’s strategic positioning and next-generation product advancements, have solidified its dominance in the industry. The AI chip market is expected to grow substantially, with various forecasts predicting a compound annual growth rateThe world of finance is replete with complex concepts, but one that stands as a cornerstone for investors seeking to gauge returns is the Compound Annual Growth Rate (CAGR). Often ... More (CAGR) between 20.8% and 40.6% over the next decade, reflecting the increasing demand for AI technologies across multiple sectors.

AI Leadership and the Demand for AI Chips

Nvidia has established itself as a cornerstone in the AI revolution, primarily due to its cutting-edge graphics processing units (GPUs). These GPUs have become the industry standard for AI applications, finding extensive use in data centers, autonomous vehicles, healthcare, and other AI-driven technologies. Nvidia’s ability to innovate and maintain its lead in this highly competitive market has significantly contributed to the upward momentum of its stock.

The demand for AI chips is robust and growing. As AI technologies are increasingly adopted across various industries, the need for powerful and efficient computing solutions has skyrocketed. Nvidia’s GPUs are uniquely positioned to meet this demand, offering the high computational power required to process complex AI algorithms and large datasets. This has not only cemented Nvidia’s position as a leader in the AI space but has also driven substantial revenue growth, reinforcing investor confidence in the company’s long-term prospects.

Strong Financial Performance

Nvidia’s financial performance has been nothing short of extraordinary, further fueling the surge in its stock price. In its fiscal first quarter, Nvidia reported a staggering 262% year-over-year increase in revenue, reaching an impressive $26 billion. This exceptional growth far exceeded analysts’ expectations and underscored the company’s ability to capitalize on the booming AI market.

The financial results have had a profound impact on investor sentiment, with many seeing Nvidia as a key player poised to benefit from the AI revolution. The company’s profit marginsIn the dynamic world of business, profitability is a fundamental metric that encapsulates a company's ability to generate earnings from its operations. Profit margins, expressed as... More have also expanded, driven by the high demand for its AI chips and the premium pricing they command. This strong financial footing has allowed Nvidia to invest heavily in research and development, ensuring it remains at the forefront of technological advancements in AI.

Market Enthusiasm for AI and Nvidia’s Strategic Position

The broader market’s enthusiasm for AI and its transformative potential across industries has significantly benefited Nvidia. As AI continues to gain traction, companies and investors alike are seeking opportunities to leverage this technology for competitive advantage. Nvidia, with its dominant position in the AI chip market, is seen as a critical enabler of this transformation.

Nvidia’s strategic partnerships and ongoing advancements in AI technology have further bolstered its reputation as a market leader. Collaborations with major tech companies and AI-focused startups have expanded Nvidia’s reach and opened up new revenue streams. Additionally, the company’s transition to next-generation products has been smooth, further enhancing its appeal to investors.

Analyst Upgrades and Price Target Increases

Reflecting the widespread optimism about Nvidia’s future prospects, several analysts have recently raised their price targets for the company. Notably, analysts from Barclays and Susquehanna have cited the strong demand for Nvidia’s AI chips and the successful launch of its new products as key reasons for their upgraded forecasts.

These analyst upgrades have played a crucial role in driving Nvidia’s stock price higher, as they signal confidence in the company’s ability to maintain its leadership position in the AI market. The positive outlook from industry experts has not only attracted more investors but also solidified the belief that Nvidia is well-positioned to continue its upward trajectory.

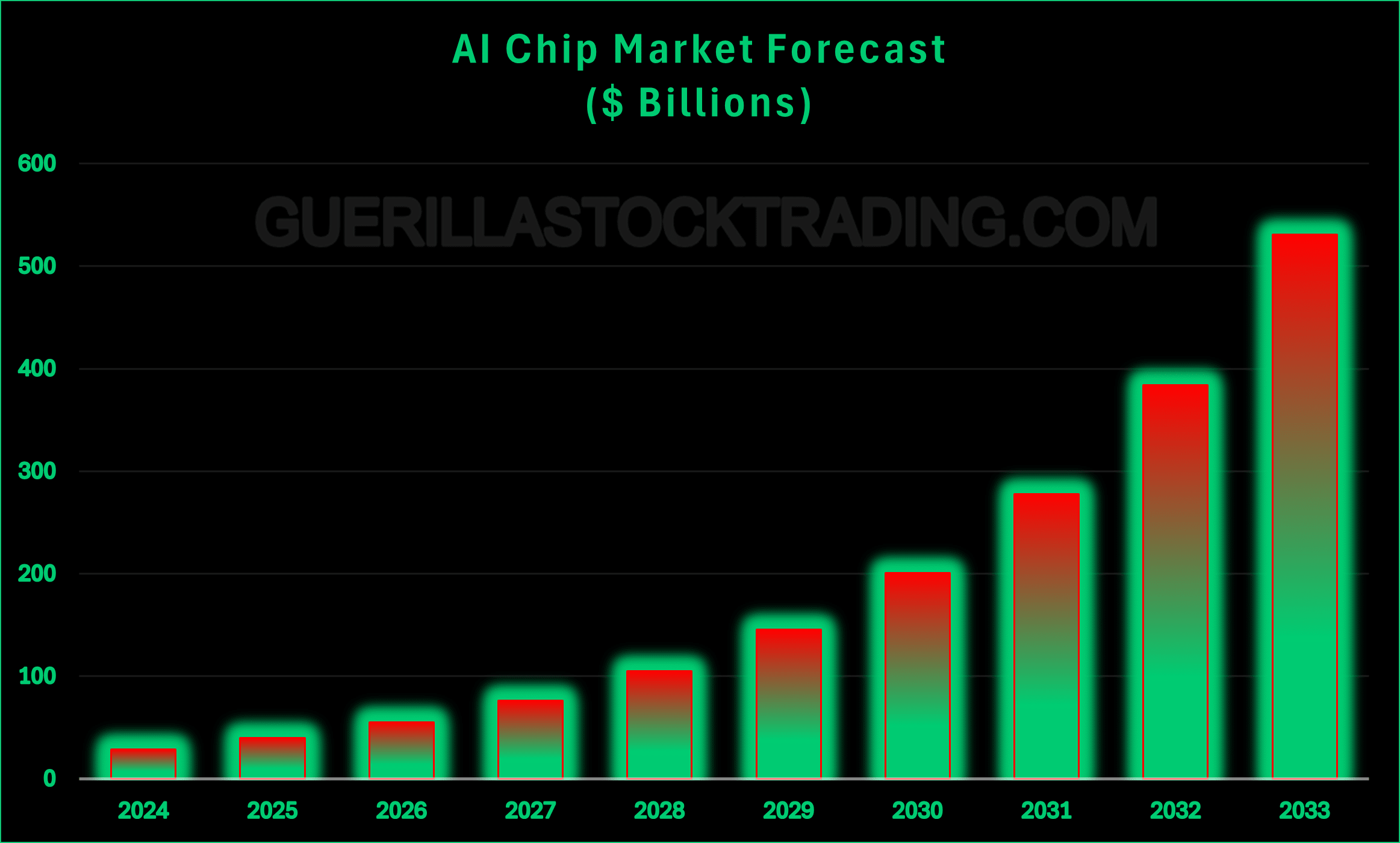

AI Chip Market Growth Forecast

The AI chip market is poised for significant growth in the coming years, with various projections highlighting the robust potential of this sector. Multiple research firms have provided optimistic forecasts, with compound annual growth rates (CAGR) ranging from 20.8% to 40.6% over the next decade.

For instance, DataHorizzon Research projects a CAGR of over 40.6% from 2023 to 2032, driven by the widespread adoption of AI technologies in sectors such as healthcare, automotive, finance, and manufacturing. AltIndex.com anticipates that the AI chip market will grow tenfold over the next ten years, reaching a market size of $300 billion by 2033. Meanwhile, Allied Market Research estimates a CAGR of 38.2% from 2023 to 2032, with the market expected to reach $383.7 billion by 2032.

These projections underscore the vast growth opportunities in the AI chip market, fueled by the increasing demand for AI-powered solutions across diverse industries. As AI continues to evolve, the need for advanced semiconductor technologies capable of handling data-intensive tasks will only grow, positioning Nvidia as a key beneficiary of this trend.

Insights

- Nvidia’s GPUs are central to AI technology, driving its stock performance.

- The AI chip market is forecasted to experience rapid growth over the next decade.

- Strong financial performance and positive market sentiment have reinforced Nvidia’s market position.

The Essence (80/20)

Core Topics:

- AI Leadership: Nvidia’s dominant position in the AI chip market, with its GPUs considered essential for AI applications.

- Financial Performance: Exceptional revenue and profit growth, far exceeding expectations, bolstering investor confidence.

- Market Trends: Broader enthusiasm for AI and its transformative potential across industries.

- Analyst Sentiment: Upgrades in stock price targets due to strong demand for AI chips and smooth transitions to next-generation products.

- AI Chip Market Growth: Projections of significant growth in the AI chip market, driven by increased adoption of AI technologies across various sectors.

The Guerilla Stock Trading Action Plan

Market Analysis: Regularly review AI market reports to anticipate shifts in technology trends and their impact on various industries.

Investment Strategy: Consider investing in Nvidia or AI-related stocks, capitalizing on the expected growth in the AI chip market.

Technology Adoption: Stay updated on AI advancements and Nvidia’s product releases to identify opportunities for integration into business operations.

Blind Spot 1: Market Saturation and Increased Competition

Issue: As the AI chip market grows, more companies will likely enter the space, increasing competition and potentially leading to market saturation, which could impact Nvidia’s market share and profitability.

Remediation: Nvidia should continue investing heavily in research and development (R&D) to maintain its technological edge and innovate beyond its current offerings. Strategic acquisitions of emerging AI technology firms could also help Nvidia stay ahead of competitors.

Blind Spot 2: Overreliance on AI Demand

Issue: Nvidia’s recent financial success is heavily tied to the demand for AI chips. Any slowdown in AI adoption or technological shifts away from GPU-centric AI processing could negatively impact the company’s revenue.

Remediation: Diversify product offerings and revenue streams by expanding into adjacent markets, such as edge computing, autonomous vehicles, and IoT (Internet of Things) technologies. This diversification will help mitigate the risks associated with fluctuating demand in the AI sector.

Blind Spot 3: Regulatory and Geopolitical Risks

Issue: As Nvidia becomes more integral to AI infrastructure, it may face increased regulatory scrutiny, particularly concerning data security and export restrictions, which could impact its global operations.

Remediation: Increase lobby spending. Proactively engage with regulators to shape policies. Develop a robust compliance framework that anticipates potential regulations. Additionally, Nvidia should explore diversifying its manufacturing and supply chain to reduce geopolitical risks.

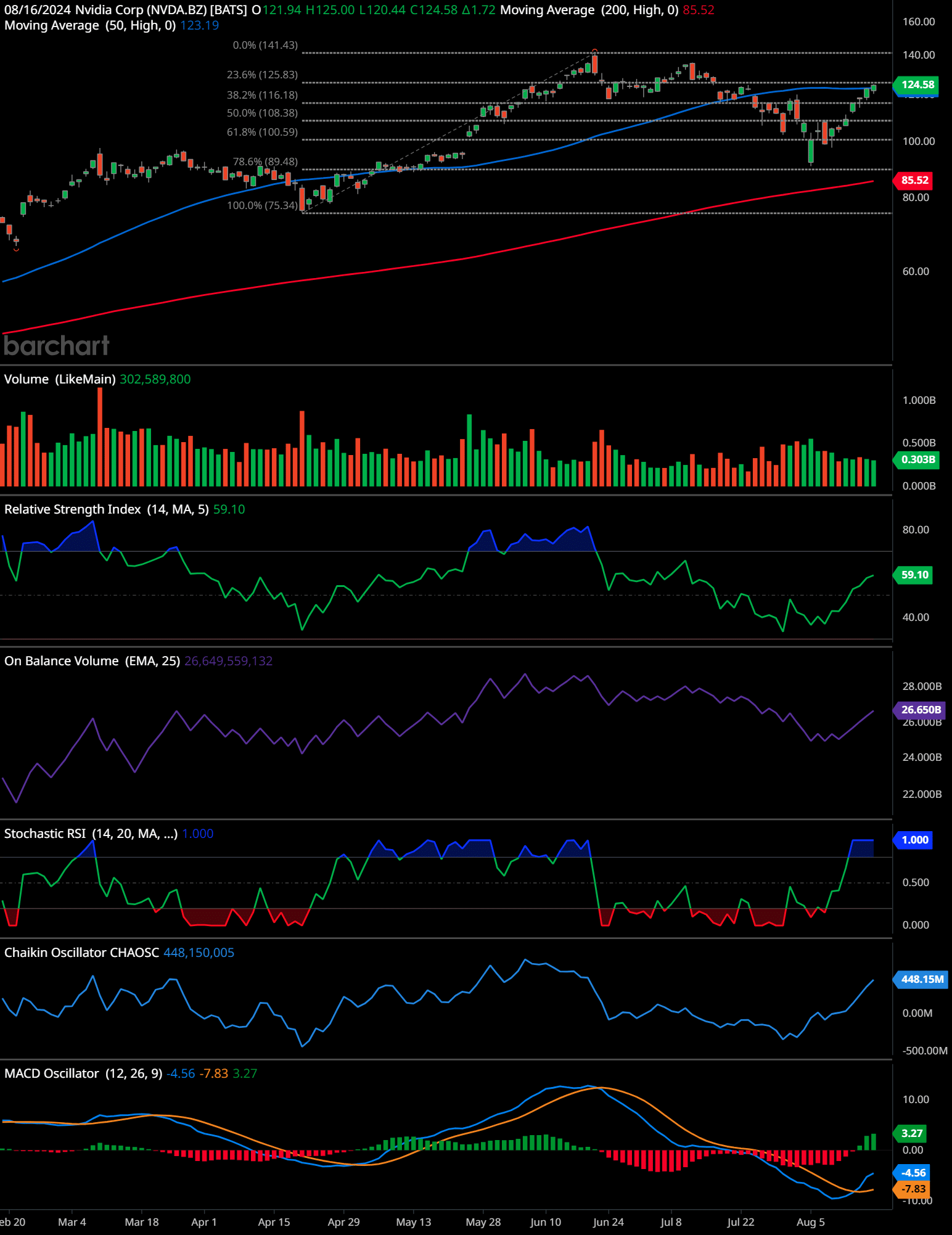

NVDA Technical Analysis (daily)

This daily chart of Nvidia Corp (NVDA) shows the stock price has been in a recovery phase after a pullback. The price has recently climbed above the 50-day moving average at $123.19, indicating short-term bullish momentum. The stock is currently trading at $124.58, which is slightly above the 61.8% Fibonacci retracementFibonacci retracement is a fundamental tool in the arsenal of technical analysts and traders. Rooted in the mathematical principles of the Fibonacci sequence, this technique is wid... More level at $123.19, further confirming a potential bullish trend continuation.

Support levels can be identified at $116.18 (50% Fibonacci retracement), $108.83 (38.2% Fibonacci retracement), and a more significant support at $100.59 (61.8% Fibonacci retracement). Resistance levels are present at $125.83 (23.6% Fibonacci retracement) and the recent peak around $140.

The Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... More (RSI) at 59.10 suggests that the stock is approaching bullish territory but has not yet entered overbought conditions, implying room for further upward movement. On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... More (OBV) shows steady accumulation, reflecting sustained buying interest. The Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ... More has just hit 1.000, indicating overbought conditions, which could signal a short-term pullback or consolidation.

The Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati... More shows an uptick, indicating increased buying pressure. The MACDThe MACD indicator is essentially a momentum indicator that shows the relationship between two different moving averages of price. The MACD is the difference between the 12-period ... More Oscillator is currently bullish, with the MACD line crossing above the signal line and positive histogram bars, supporting the upward trend.

Time-Frame Signals:

- 3 Months: Buy – The bullish crossover in MACD and the RSI trend suggest continued upward momentum.

- 6 Months: Hold – Potential resistance at $140 may challenge further gains; consolidation or pullback possible.

- 12 Months: Hold – Longer-term bullishness is tempered by the need for the stock to break above significant resistance levels for a sustained uptrend.

In summary, the chart indicates a short-term bullish trend, with potential for further gains, but caution is advised as the stock approaches key resistance levels.

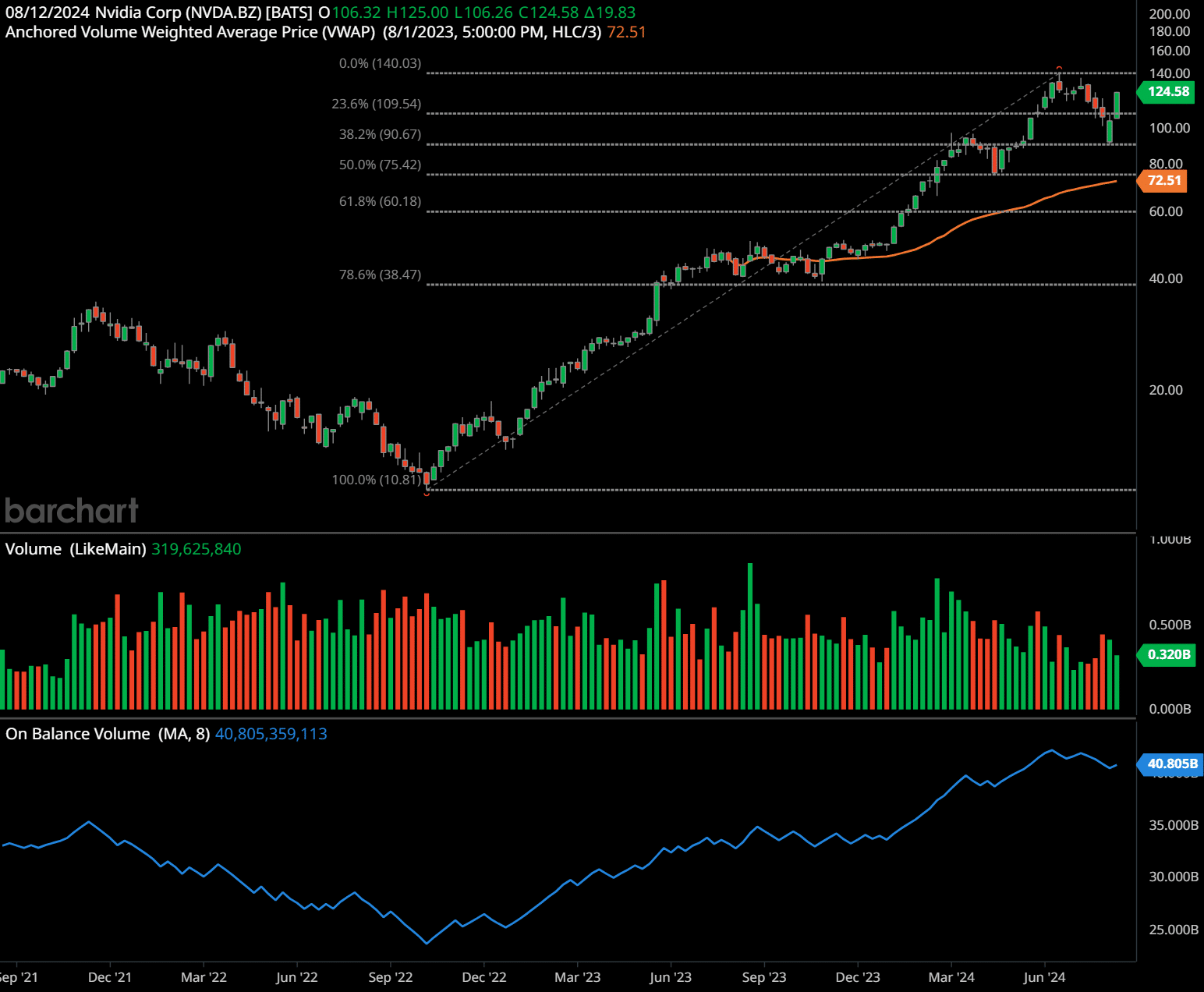

NVDA Technical Analysis (weekly)

This weekly chart of Nvidia Corp (NVDA) highlights a strong long-term uptrend that started around October 2022. The stock has been consistently moving higher, with significant gains over the past year. The price is currently trading at $124.58, which is just below the recent peak at $140.03.

Support levels can be identified at $100.67 (50% Fibonacci retracement) and $72.51 (Anchored VWAP), with a more substantial support level at $60.18 (61.8% Fibonacci retracement). These levels are key for the stock’s long-term stability. Resistance is at the recent high of $140.03, with further potential resistance near $160.

The On Balance Volume (OBV) indicator shows consistent accumulation, reflecting strong buying interest over the long term. This suggests that the uptrend is supported by volume, which is a positive sign for future price action.

Time-Frame Signals:

- 1 Year: Hold – The stock may face resistance around $140, leading to potential consolidation or a pullback. However, the long-term uptrend remains intact.

- 2 Years: Buy – The overall bullish trend suggests further gains are likely, particularly if the stock can break through the $140 resistance.

- 3 Years: Buy – Continued strength in the OBV and the long-term uptrend point to sustained bullish momentum over this period, with higher price targets likely.

The chart indicates that Nvidia is in a strong long-term uptrend, supported by solid volume and a series of higher highs and higher lows. However, the stock is approaching a key resistance level at $140, which may pose a challenge in the short term. A break above this level could signal further gains, while failure to do so might result in consolidation or a pullback to the support levels identified.

Past performance is not an indication of future results. This article should not be considered as investment advice. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions. 🧡

Looking Ahead

Nvidia’s stock surge is a testament to its leadership in the AI sector, strong financial performance, and the broader market’s enthusiasm for AI’s potential. As the company continues to innovate and expand its reach in the AI chip market, it is well-positioned to capitalize on the growing demand for AI technologies. With analysts predicting robust growth for the AI chip market, Nvidia’s stock is likely to remain a top performer, making it a compelling choice for investors seeking to benefit from the AI revolution.

Frequently Asked Questions

1. Why has Nvidia’s stock been experiencing significant upward momentum?

Nvidia’s stock has been rising due to its leadership in the AI sector, strong financial performance, and market enthusiasm for AI technologies.

2. What role does AI play in Nvidia’s stock price increase?

AI is a major driver of Nvidia’s stock price, with the company’s GPUs being the gold standard for AI applications, leading to strong demand in data centers and other AI-driven technologies.

3. How has Nvidia’s financial performance impacted its stock price?

Nvidia has reported impressive financial results, including a 262% year-over-year increase in revenue in its fiscal first quarter, which has significantly boosted investor confidence and the stock’s value.

4. What is the market’s overall sentiment towards AI and Nvidia?

The market is highly enthusiastic about AI’s potential to transform industries, which has fueled investor interest in Nvidia, positioning the company to capitalize on this trend.

5. Have analysts upgraded their price targets for Nvidia?

Yes, several analysts have raised their price targets for Nvidia, citing strong demand for the company’s AI chips and a smooth transition to next-generation products.

6. What is the forecast for the AI chip market’s growth?

The AI chip market is expected to grow significantly, with various projections estimating a compound annual growth rate (CAGR) between 20.8% and 40.6% over the next decade.

7. How does DataHorizzon Research view the AI chip market’s growth potential?

DataHorizzon Research projects a CAGR of over 40.6% from 2023 to 2032, driven by the increasing adoption of AI technologies across various sectors.

8. What market size does AltIndex.com anticipate for the AI chip market by 2033?

AltIndex.com anticipates the AI chip market will grow tenfold over the next ten years, reaching a market size of $300 billion by 2033.

9. What are the projections from Allied Market Research for the AI chip market?

Allied Market Research estimates a CAGR of 38.2% from 2023 to 2032, with the market projected to reach $383.7 billion by 2032.

10. How does Future Market Insights forecast the AI chip market?

Future Market Insights forecasts a CAGR of 26.4% from 2024 to 2034, with the market expected to reach $287 billion by 2034.

11. What does MarketsandMarkets predict for the AI chip market by 2028?

MarketsandMarkets predicts a CAGR of 20.8% from 2023 to 2028, with the market size reaching $131.8 billion by 2028.

12. What factors are driving the growth of the AI chip market?

The growth of the AI chip market is driven by the increasing demand for AI-powered technologies, advancements in semiconductor technology, and the need for high computing power for data-intensive tasks.

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.