Target’s stock, currently trading over 40% below its 2021 peak, offers an attractive opportunity for long-term investors. The company’s strategic initiatives, including the expansion of private-label brands, store remodels, and the introduction of new innovations, position it for a multi-year profit recovery. Despite concerns about a slowing U.S. consumer, recent positive economic indicators, such as strong retail sales and improved consumer sentiment, suggest resilience. Target’s focus on discretionary spending and its premium brand positioning make it well-suited to benefit from easing macroeconomic pressures. Moreover, Target’s private-label brands, which have seen unprecedented success, contribute significantly to its sales and margins. The company’s long-term strategy also includes an extensive store redesign and expansion plan, expected to generate substantial additional sales and drive strong returns on capital.

Economic Outlook: Consumer Strength Amidst Market Volatility

The broader economic landscape has been fraught with uncertainty, with fears of a slowing U.S. consumer driving market volatility. Recent headlines have amplified concerns, particularly following a weak July jobs report that sent Wall Street into a tailspin. The market’s reaction was swift, with the VIX spiking to levels reminiscent of the COVID-19 pandemic and the Great Financial Crisis. Amidst the panic, there were even calls for emergency rate cuts of up to 75 basis points. However, as history has shown, such overreactions are not uncommon in the financial markets.

In the weeks following the initial panic, more positive economic data began to emerge, suggesting that fears of a hard landing might have been exaggerated. The July U.S. retail sales report, for instance, showed a 1% increase, significantly outperforming the consensus forecast of 0.3%. This rebound in consumer spending was a welcome sign, indicating that the economic situation may not be as dire as initially feared. Furthermore, the University of Michigan’s August consumer sentiment survey registered an uptick, marking the first increase in five months. This resurgence in consumer confidence was further bolstered by Walmart’s recent earnings report, which highlighted a 4.2% increase in U.S. same-store sales. These strong results propelled Walmart’s shares to new all-time highs and provided a boost to the entire retail sector, including Target.

Target’s Unique Market Position: Discretionary Spending and Premium Branding

Unlike other consumer staples, Target is more heavily reliant on discretionary spending and is positioned as a premium brand within the retail sector. This distinguishes it from competitors like Walmart and Costco, which cater more to budget-conscious consumers. Target thrives in environments where consumers have extra cash and are inclined to make impulse purchases—a category that accounts for 21% of Target’s sales, compared to just 12% at Walmart. This premium reputation was particularly evident during the pandemic when Target’s stock nearly tripled as middle-class consumers, buoyed by stimulus cash, flocked to its stores.

As macroeconomic pressures and cyclical headwinds begin to ease, there is an expectation that the current focus on bargain hunting will diminish. With discretionary spending on the rise, consumers are likely to gravitate towards higher-end products, allowing Target to reclaim market share. The company’s ability to cater to a more affluent demographic, primarily suburban mothers aged 35 to 44 with household incomes of $80,000, positions it well for a recovery as consumer spending rebounds.

The Rise of Private-Label Brands: A Strategic Growth Driver

Private-label brands have long been a staple in the retail industry, often gaining popularity during periods of economic uncertainty. In today’s value-focused environment, these brands have experienced unprecedented success, with sales reaching all-time highs in the first half of 2024. Consumers are increasingly seeking value without sacrificing quality, and Target’s private-label offerings have risen to the occasion. The company’s nearly 50 owned brands, which contribute over $30 billion in annual sales, have become key drivers of growth. Brands like Threshold, Everspring, and All in Motion have become household names, with top performers like Good & Gather and Up & Up generating annual sales of $4 billion and $3 billion, respectively.

Retailers have also benefited from the rise of private-label brands, as they no longer need to share sales with national brands and can allocate prime shelf space to their own products. With fewer intermediaries in the supply chain, these private labels offer outstanding margins. Target’s portfolio of private brands is among the most successful in the industry, providing a significant competitive advantage.

Store Expansion and Remodeling: Investing in the Future

Another cornerstone of Target’s long-term strategy is its ambitious store expansion and remodeling plan. The company plans to remodel most of its nearly 2,000 stores, with roughly 1,200 already underway. Over the next decade, Target expects to open 300 new locations, each featuring enhanced design elements such as more natural light and reclaimed wood to appeal to its core customer base, particularly Gen Z. These new stores will be about 20,000 square feet larger than traditional layouts to accommodate the growing demand for same-day delivery services.

This strategy highlights one of Target’s major competitive advantages: a unique, all-in-one shopping experience that rivals struggle to match. Some remodeled Targets have a Starbucks while others have a Pizza Hut inside the store. The success of this model is evident in the numbers, with beauty remaining a standout category in Q1, driven by the strength of Ulta Beauty at Target stores. Over the next decade, these new and remodeled stores are expected to generate an additional $15 billion in annual sales. Target’s management anticipates capital expenditures of between $3.5 billion and $5.5 billion annually starting in 2025. While this represents a sizable investment, the historically strong returns from remodels provide confidence in the company’s ability to generate high returns on invested capital, which currently stands at 15.4% and is expected to climb into the high teens over time.

Insights:

- Target’s focus on discretionary spending makes it sensitive to economic cycles.

- Private-label brands are a key growth driver for Target, offering high margins.

- Store expansion and redesign are central to Target’s long-term growth strategy.

The Essence (80/20):

Core Topics:

- Strategic Initiatives: Target’s private-label brands and store expansion/remodeling are crucial to its multi-year growth plan.

- Economic Resilience: Recent positive retail data and consumer sentiment suggest a resilient U.S. consumer base, supporting Target’s recovery.

- Premium Positioning: Target’s focus on discretionary spending and impulse buys positions it advantageously as consumer spending rises.

The Guerilla Stock Trading Action Plan:

- Invest in Target Stock: Consider buying shares at current levels, leveraging the expected multi-year recovery and profit growth.

- Monitor Economic Indicators: Keep an eye on U.S. consumer data to gauge potential impacts on Target’s performance.

- Follow Store Expansion: Track the progress of Target’s store remodels and openings to assess their impact on sales growth.

Blind Spot:

While Target’s premium positioning and reliance on discretionary spending are strengths in a healthy economy, these factors could also be vulnerabilities if economic conditions worsen unexpectedly.

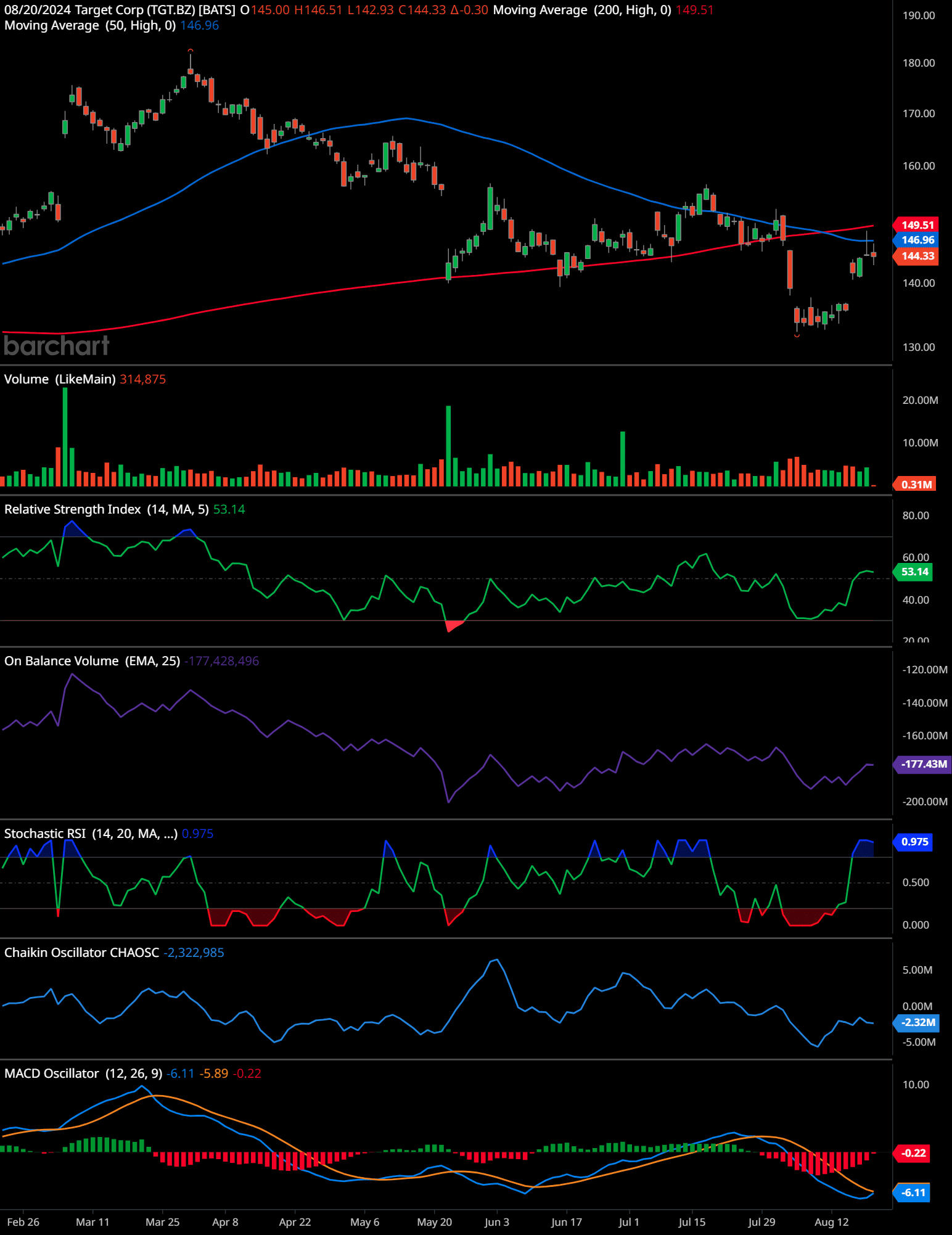

TGT Technical Analysis (daily)

Time-Frame Signals:

3-Month Outlook:

The stock has been in a downtrend since May, with lower highs and lower lows indicating bearish momentum. Recently, the price has shown some recovery, but it faces resistance around the 50-day moving average (currently at $146.96) and the 200-day moving average (currently at $149.51). The Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... More (RSI) is at 53.14, which suggests that momentum is neither strongly bullish nor bearish at this point. However, the Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ... More is at 0.975, indicating that the stock might be overbought in the short term. The MACDThe MACD indicator is essentially a momentum indicator that shows the relationship between two different moving averages of price. The MACD is the difference between the 12-period ... More is slightly negative with a histogram close to zero, indicating a lack of strong momentum in either direction. The Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati... More is negative, suggesting weak buying pressure. Given these indicators, the short-term signal leans toward Hold, with caution around the $147-$150 resistance zone.

6-Month Outlook:

The longer-term trend remains bearish, with the stock trading below both the 50-day and 200-day moving averages. The On-Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... More (OBV) is in a downtrend, indicating that volume is not supporting a sustained upward movement. The Chaikin Oscillator’s negative reading also reinforces this lack of buying interest. The MACD shows a bearish crossover, although the signal is weak. Resistance is strong around $149-$150, which coincides with the 200-day moving average. Support is near the recent lows around $140 and $130. The outlook suggests a Hold or potentially a Sell if the stock fails to break above the $150 level convincingly.

12-Month Outlook:

Given the sustained downtrend and the lack of strong bullish signals, the longer-term outlook is cautious. The resistance at the 200-day moving average around $149.51 is crucial; if the stock fails to break above this level, it could continue its downtrend. Support levels at $140 and $130 will be critical to watch. The ongoing negative trend in the OBV and Chaikin Oscillator suggests that even if the stock rebounds, it may face selling pressure at higher levels. For the 12-month period, the signal leans toward Sell unless there is a significant reversal confirmed by a break above the $150-$155 range.

Support and Resistance Levels:

- Support Levels: $140, $130

- Resistance Levels: $146.96 (50-day MA), $149.51 (200-day MA), $155 (longer-term resistance)

Future Trends:

The chart indicates that the stock is currently in a consolidation phase after a downtrend, with potential resistance at the $146-$150 range. If the stock fails to break above these levels, it could resume its downward trend, especially given the bearish indicators in the OBV and Chaikin Oscillator. However, a strong break above $150 could signal a reversal, though this scenario appears less likely given the current indicators.

TGT Technical Analysis (weekly)

Time-Frame Signals:

1-Year Outlook:

The stock has been in a sustained downtrend over the past year, with a series of lower highs and lower lows. The 40-week exponential moving average (EMA) is at $152.04, and the 150-week EMA is at $158.66, both acting as strong resistance levels. The price is currently below these moving averages, indicating bearish momentum. The Anchored VWAP from August 2023 sits at $139.08, which may act as a potential support level. The On-Balance Volume (OBV) shows a slight increase recently but remains in a downtrend, suggesting that selling pressure is still dominant. Given these indicators, the 1-year outlook signals a Sell, especially if the stock fails to break above the $152-$159 resistance zone.

2-Year Outlook:

Over the past two years, the stock has seen significant volatility, with peaks in late 2022 followed by a consistent downtrend throughout 2023 and into 2024. The 150-week EMA at $158.66 is a critical resistance level that has been tested multiple times but not breached, suggesting that the long-term trend remains bearish. The Anchored VWAP at $139.08 provides support, but the overall downtrend in OBV and the stock’s inability to stay above key moving averages suggest continued weakness. For the 2-year period, the signal is Hold, with a potential to move to Sell if downward pressure continues and the stock fails to stay above $140.

3-Year Outlook:

The 3-year trend indicates a gradual decline in the stock price, with the current price trading well below its highs from earlier years. The downward-sloping 150-week EMA reinforces the bearish long-term trend. Support is seen around $130, with resistance at $158-$160. The OBV trend also points to persistent selling pressure, making a significant reversal unlikely unless there is a substantial change in market conditions or company fundamentals. The 3-year outlook remains Hold with a cautious bias toward Sell if the stock fails to regain strength above key resistance levels.

Support and Resistance Levels:

- Support Levels: $139.08 (Anchored VWAP), $130 (long-term support)

- Resistance Levels: $152.04 (40-week EMA), $158.66 (150-week EMA), $160 (long-term resistance)

Future Trends:

The chart indicates that the stock is struggling to break through significant resistance levels, suggesting that the bearish trend could continue. The price is currently below major moving averages, and the OBV remains weak, implying that any rallies may be short-lived unless supported by strong buying volume. If the stock cannot break above the $152-$159 resistance area, it is likely to test lower support levels around $130.

Disclaimer: Past performance is not an indication of future results, and this analysis should not be considered as investment advice. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions. 🧡

Looking Ahead

In conclusion, Target’s strategic initiatives, including its focus on private-label brands, store expansion, and remodels, position the company for a multi-year profit recovery. Despite recent market volatility and concerns about a slowing U.S. consumer, positive economic signals and Target’s premium market positioning suggest that the company is well-equipped to navigate these challenges. As discretionary spending increases, Target is poised to reclaim market share and deliver robust comparable sales growth. For long-term investors, the current dip in Target’s share price represents an excellent opportunity to invest in a company with strong growth prospects and a clear path to profitability.

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.