There is no better tool to forecast the future direction of a stock than options flow analysis.

Options are bets on what a stock will be trading at in the future. That’s why you need to add options flow analysis to your toolbox even if you don’t trade option contracts.

Options flow analysis is difficult and sometimes feels like reading tea leaves at the bottom of a cup. In this lesson, we break down the basics of options flow analysis to make the practice much easier for you.

What Options Flow Is

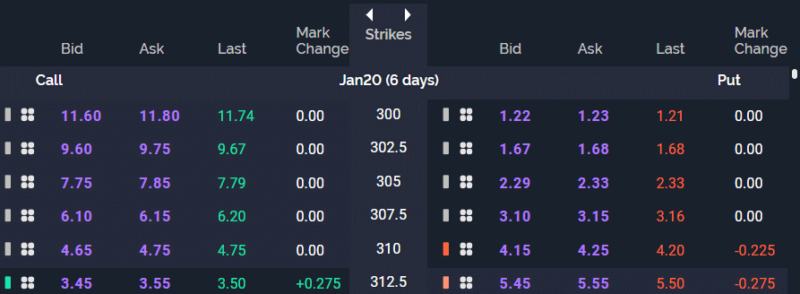

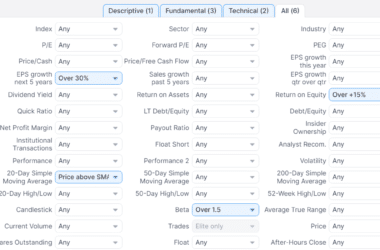

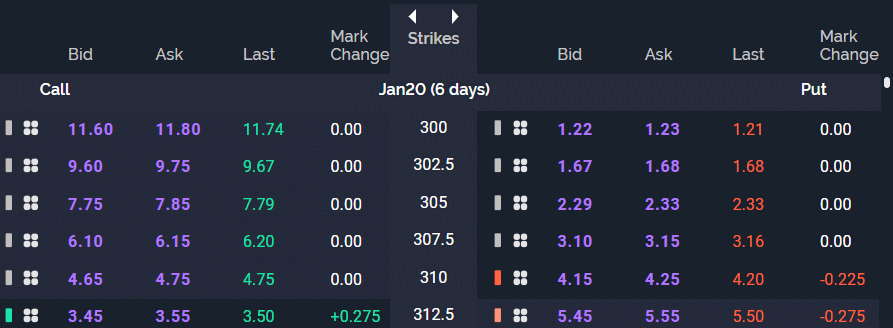

Options flow is different than options contracts. You can see a jumbled mess of options on almost all trading platforms.

Options flow has a completely different view of options than your online broker’s options chain for a given security.

Options flow analysis is the tracking of option sweeps so that we can get an idea of what large players (i.e. smart money) are thinking. These large players are usually institutional traders, market makers, proprietary trading firms, financial firms, and commercial banks. These option sweeps can range from anywhere between thousands of dollars to millions of dollars. Large players often know something about the market that we don’t. After all, they are trading with a multi-million dollar treasure chest so they are not just playing a coin-flip guessing game like most smaller retail traders. Put simply, options sweeps often proceed a big move in the underlying stock.

Takeaway: Don’t confuse options flow with an options chain. Options flow is focused on tracking sweeps caused by very large orders placed by large players.

Options Flow Basics – Bullish Puts

Calls are bets the market will go up. Puts are bets the market will go down so how can puts be bullish?

If you are buying a put, yes, that is bearish because you hope the price of the underlying stock is going to decrease. But, would you close that position if you thought the price was going to continue to drop?

Put flow that comes in “BB,” means it was traded below the bid. This means (99% of the time) that someone either sold those puts, or wrote the contracts. Both are bearish scenarios.

Puts that are listed with a BB (Below Bid) on the end are bullish. Puts with a AA (Above Ask) are bearish. Conversely, calls that are listed with a BB on the end are bearish, while calls with a AA are bullish.

GET A SPECIAL TRIAL OFFER TO BB THROUGH GUERILLA STOCK TRADING

Takeaway: Don’t jump out of a long position just because you see a lot of put action. If those puts are traded below the bid, that means someone else wants to get out of those puts as fast as possible which is actually bullish!

Options Flow Signal – Bullish Flow

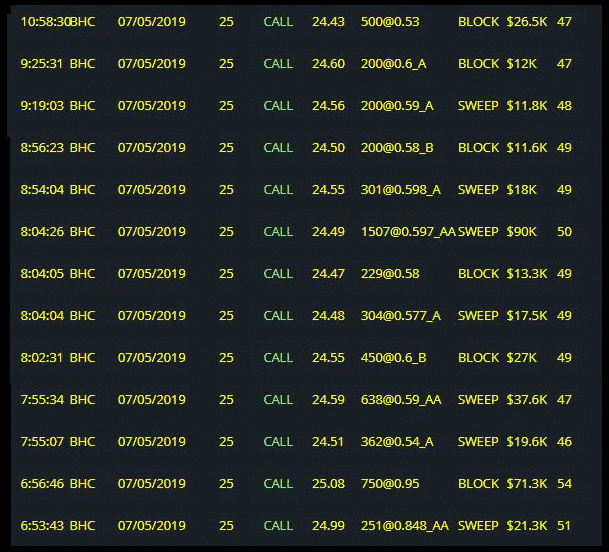

Check out the options flow on BHC.

The flow just kept coming in all day. The first hit on this strike was at 6:53 AM. The last trade with this strike/expiration combo was at 10:58 AM. Throughout the day, buyers were stepping in and pounding this one. Other strikes and expirations were hit too.

Takeaway: When you see constant flow on a ticker, throughout the entire day, that’s something to take a look at!

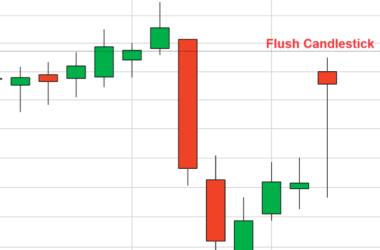

Options Flow – Rapidfire Flow

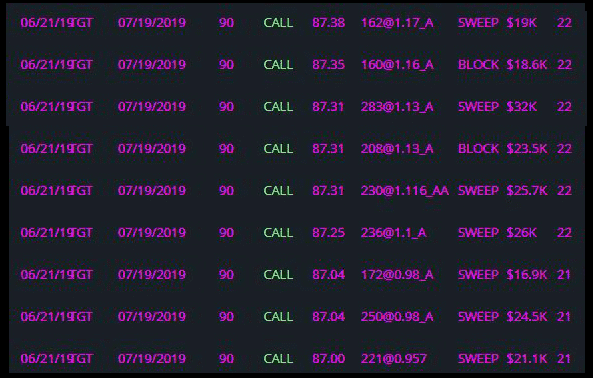

Here is what a beautiful options flow looks like:

Look at how the same strike, same expiration was just pounded. The buying was relentless, boom, boom, boom!

Notice how the price of the contracts started at $0.96 and went to $0.98, $1.10, $1.16, $1.17, etc. We want to see the price keep increasing, as buyers keep coming in.

Takeaway: This is options flow that we will follow.

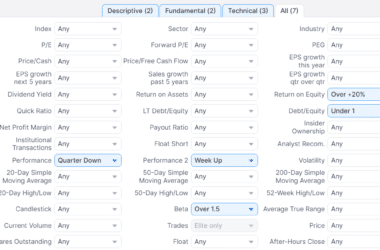

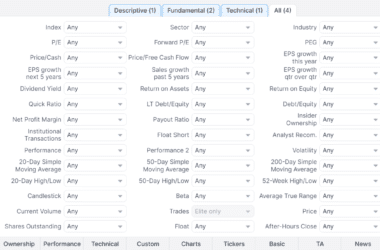

Options Flow – Sneaky Whites

“Sneaky Whites” refers to options flow this colored all white in BlackBox.

All white colored options flow means open interest has not been met yet. The BABA contract above has 20,010 in open interest and the number of contracts traded above is 1209.

Why is it sneaky? We don’t pay attention to options flow that is white because it doesn’t show the conviction that purple and yellow show. This doesn’t mean that you can’t use Sneaky Whites as a trading signal though.

Takeaway: The Sneaky Whites flow above is actually nice because it has the same strike, same expiration, and it all came in within a 22 minute period. They’re mostly sweeps, all traded on the Ask. The price of this contract is increasing with each trade.

Options Flow – Acceptable Blocks / Same Buyer

Sometimes a block order can give us additional information.

In this case, this is the same contract in back to back transactions. The price is the sasme as the previous sweep, which was traded on the ask.

This is the same buyer. Even though one trade went through as a block, these three trades are the same buyer. Since it is the same buyer, we won’t discount the value of this trade.

Takeaway: Most often you should ignore single blocks. This one, however, is the same buyer as the other two. Since it is the same buyer, it now gives more weight to the other flow we see here.

Options Flow – OMG I’m in Calls, Look At Those Puts Should I Sell?

Let’s say you were in those purple calls that were 2/19 $28’s. Then you see the put flow come in that is 3/12 puts. Should you panic and sell? No.

If you look at the news feed on the right in your BlackBox interface, there is a lockup period expiring on February 18th. Some traders are buying puts in anticipation of a lockup expiration sell-off. Those 2/19 calls are a short-term play on the Palantir and Akin Gump collaboration news. The puts, however, are dated for nearly a month AFTER that. Therefore, the short-term play will not be affected by those puts coming in based on the short-term catalystA stock catalyst is an engine that will drive your stock either up or down. A catalyst could be news of a new contract, SEC filings, earnings and revenue beats, merger and acquisit... More.

Takeaway: These puts are longer term dated, and will not have any impact on the shorter term play, which was based on a shorter term catalyst. Don’t sell the calls because of those puts.

Options Flow Mixed

Say you were looking to trade this ticker today. Flow starts coming in. You’re watching it closely. More flow comes in. Here we have calls, puts, blocks, sweeps, there’s just nothing consistent about what we see here. If you were trying to trade this ticker off of flow, there would be no trade. Strikes, expirations, calls, puts, it’s just all over the place.

Takeaway: When you see flow on a ticker that just doesn’t tell a story, move on. This flow tells us nothing about what the big money thinks of this ticker because it’s probably just smaller retail traders doing their own thing. If you’re looking to trade off of flow, move on to another stock when you see mixed options flow like this.

As you can see, tracking options order flow is extremely valuable for all trades you make even if you are just trading the underlying stock.

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.