Pasithea Therapeutics (KTTA) experienced a significant increase in its stock price on August 5, 2024. This surge was primarily driven by the company’s positive developments in its ongoing clinical trials, specifically for its promising treatment candidate, PAS-004.

Positive Developments in Clinical Trials

Pasithea Therapeutics announced the successful completion of enrollment and initial dosing of the second cohort in its Phase 1 clinical trial for PAS-004. This next-generation macrocyclic MEK inhibitor is targeted at treating neurofibromatosis type 1 (NF1) and potentially other conditions. The progress marks a significant milestone for the company and its innovative approach to treatment.

Phase 1 Clinical Trial Progress

The recent progress follows a favorable safety review by an independent Safety Review Committee. The committee’s recommendation to escalate to the next dose level without any modifications was based on the absence of dose-limiting toxicities or significant adverse events in the initial cohort. This positive safety profile is critical in the early stages of clinical trials and enhances the potential for PAS-004 as a viable treatment option.

Investor Confidence and Stock Performance

These advancements in Pasithea Therapeutics’ clinical trials have likely bolstered investor confidence, leading to the notable rise in the company’s stock price. On August 5, 2024, Pasithea Therapeutics’ stock closed at $5.75, marking a substantial increase from its previous close of $5.00. This uptick reflects the market’s optimistic response to the company’s clinical progress and potential future developments.

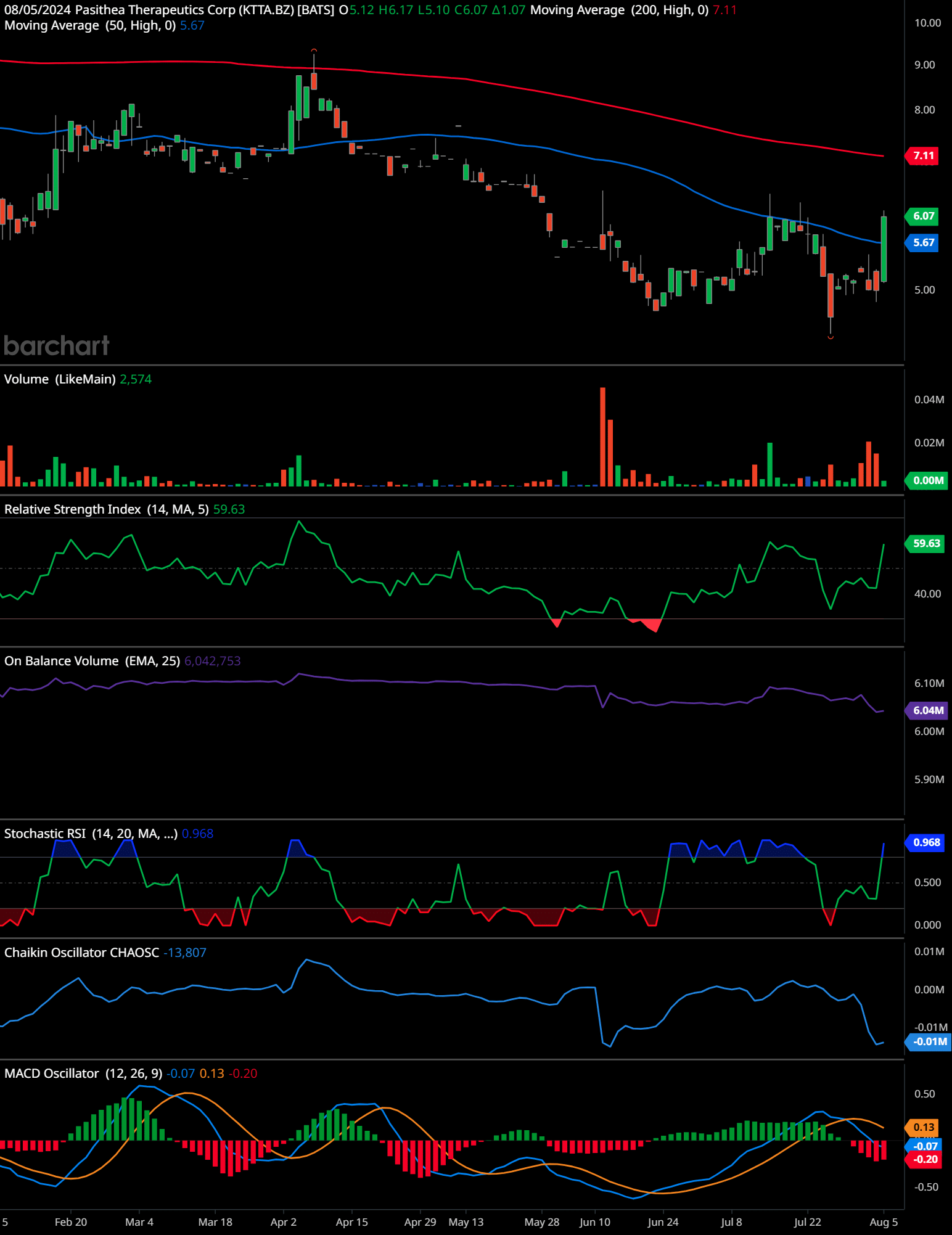

KTTA Technical Analysis

Pasithea Therapeutics Corp (KTTA) Daily Technical Analysis:

The stock price is currently trading at $6.07, having shown a recent upward movement. The 50-day moving average is at $5.67, acting as a support level, while the 200-day moving average at $7.11 acts as a resistance.

The Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... More (RSI) is at 59.63, indicating a neutral to slightly bullish momentum as it approaches the 60 level.

The On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... More (OBV) shows a slight decline, suggesting weak buying pressure.

The Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ... More is at 0.968, indicating the stock is in an overbought condition, suggesting a possible pullback.

The Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati... More is at -13,807, signaling a bearish divergence, indicating potential distribution.

The MACDThe MACD indicator is essentially a momentum indicator that shows the relationship between two different moving averages of price. The MACD is the difference between the 12-period ... More oscillator shows the MACD line at 0.13 above the signal line at -0.07, with the histogram at 0.13, suggesting a bullish crossover and potential upward momentum.

Key Levels:

Support: $5.67 (50-day MA)

Resistance: $7.11 (200-day MA)

Time-Frame Signals:

3 Months: Hold

6 Months: Hold

12 Months: Buy

Past performance is not an indication of future results. This article should not be considered as investment advice. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions. 🧡

Looking Ahead

Pasithea Therapeutics’ recent achievements in their clinical trials for PAS-004 have positively impacted their stock performance. The successful completion of the second cohort enrollment and initial dosing, coupled with a positive safety review, has strengthened investor confidence and highlighted the company’s potential in developing innovative treatments for NF1 and other conditions. As the trials progress, Pasithea Therapeutics remains a company to watch in the biotechnology sector.

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.