Phathom Pharmaceuticals (PHAT) stock has been trending upwards for various reasons. As of July 11, 2024, the stock price rose by 8.33% to $11.32. Analysts are optimistic with an average price target of $22.00, indicating a potential 73.64% increase. The stock has a Strong Buy consensus based on 4 buy and 1 hold ratings. The company’s promising drug pipeline, particularly vonoprazan in Phase 3 trials, is key to its future valuation. This drug represents a significant innovation in the U.S. erosive GERD market. Additionally, Phathom has delivered earnings and revenue surprises, outperforming industry peers and showing strong technical indicators. The stock’s RS Rating recently increased to 86, highlighting its price performance over the past year.

Analyst Optimism and Consensus

Analyst Price Targets

Wall Street analysts have shown a strong bullish stance on Phathom Pharmaceuticals. The average price target is set at $22.00, suggesting a substantial upside potential of 73.64% from the current price. This optimism from analysts highlights their confidence in the company’s future prospects and growth potential.

Strong Buy Consensus

Phathom Pharmaceuticals boasts a consensus rating of Strong Buy, derived from 4 buy ratings and 1 hold rating. This positive sentiment from experts further bolsters investor confidence, suggesting that the stock is a promising investment opportunity.

Promising Drug Pipeline

Vonoprazan: A Game-Changer

Phathom Pharmaceuticals is at a pivotal juncture with two upcoming Phase 3 readouts for its pipeline drug, vonoprazan. This drug has already demonstrated success in multiple Phase 3 trials overseas and is now undergoing U.S. trials. The potential approval and commercialization of vonoprazan could significantly enhance the company’s valuation and future prospects.

Market Potential

Vonoprazan represents a first-in-class potassium-competitive acid blocker (PCAB), marking the first major innovation in the U.S. erosive GERD market in over three decades. This groundbreaking development positions Phathom Pharmaceuticals as a key player in addressing unmet medical needs and capturing significant market share.

Financial Performance and Surprises

Earnings and Revenue

For the quarter ended March 2024, Phathom Pharmaceuticals delivered earnings and revenue surprises of 0.70% and 30.73%, respectively. Outperforming market expectations often boosts investor confidence and drives stock prices higher, as demonstrated by Phathom’s recent performance.

Industry Outperformance

Over the past year, Phathom Pharmaceuticals has outperformed its overall industry. This relative strength compared to its peers makes the company an attractive option for investors seeking sector leaders and robust performance.

Technical Indicators and Trends

Rising Trend

The stock has exhibited a strong rising trend in the short term, with expectations of continued growth. Buy signals from both short and long-term moving averages indicate a positive forecast, reinforcing the stock’s upward momentum.

Improved Relative Strength Rating

Phathom Pharmaceuticals’ Relative Strength (RS) Rating recently jumped to 86, placing it in the 80-plus percentile. This technical indicator suggests that the stock is outperforming 86% of all stocks in terms of price performance over the past year. Such a strong RS Rating can attract momentum investors looking for high-performing stocks.

Insights:

- Phathom Pharmaceuticals’ stock shows strong upward momentum and investor confidence.

- Analysts project significant upside potential with a $22.00 price target.

- Vonoprazan’s Phase 3 trials are critical for future valuation.

- Strong technical indicators and improved RS Rating attract momentum investors.

The Essence (80/20)The Origins and Evolution of the 80/20 Principle The Discovery by Vilfredo Pareto In 1897, Italian economist Vilfredo Pareto uncovered a striking pattern in his study of wealth and... More:

- Core Topics:

- Stock Performance: Recent 8.33% rise in stock price.

- Analyst Optimism: $22.00 price target, 73.64% potential upside.

- Consensus Rating: Strong Buy with 4 buy and 1 hold ratings.

- Drug Pipeline: Upcoming Phase 3 readouts for vonoprazan, a first-in-class PCAB.

- Market Impact: Potential major innovation in the U.S. erosive GERD market.

- Earnings/Revenue Surprises: Positive surprises boosting investor confidence.

- Industry Outperformance: Stronger performance relative to peers.

- Technical Indicators: Rising trend and improved RS Rating.

The Guerilla Stock Trading Action Plan:

- Investing Strategy:

- Buy: Consider purchasing shares based on Strong Buy consensus and positive technical indicators.

- Monitor: Keep an eye on vonoprazan’s Phase 3 trial results.

- Analyze: Watch for further earnings and revenue reports for continued outperformance.

Blind Spots:

Market Competition: New competitors entering the GERD market might affect Phathom’s market position.

Regulatory Risks: Potential delays or negative outcomes in vonoprazan’s Phase 3 trials could impact stock valuation.

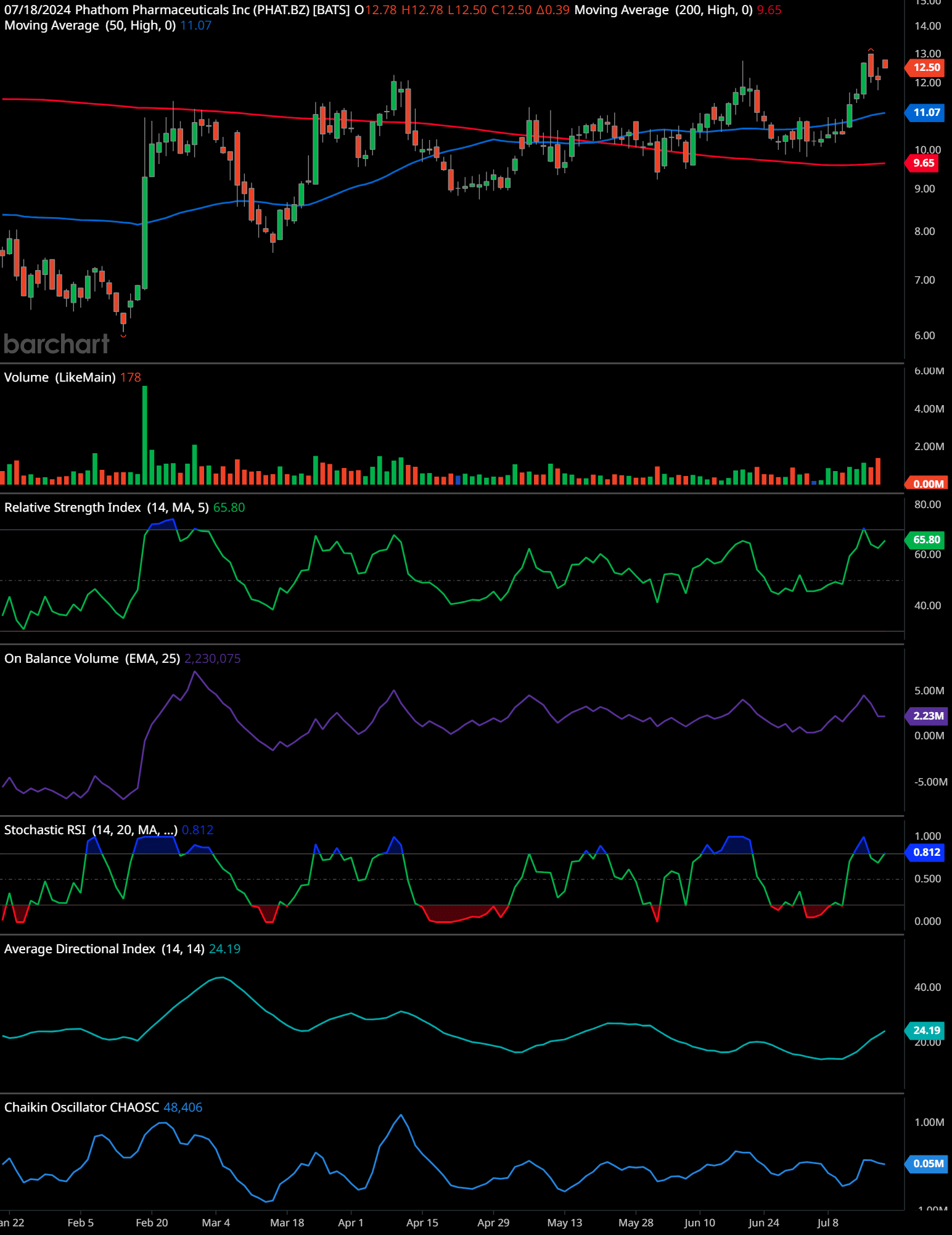

PHAT Technical Analysis

The chart for Phathom Pharmaceuticals (PHAT) shows the following technical analysis:

The stock has shown a recent upward trend, recovering from a low of approximately $9.00 in early June to the current level of $12.50. The 50-day moving average (blue line) is at $11.07, and the 200-day moving average (red line) is at $9.65, indicating a bullish trend as the stock price is above both averages.

Volume has shown periodic spikes, indicating periods of strong buying interest, though the recent volume seems average.

The Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... More (RSI) is at 65.80, close to the overbought threshold of 70, suggesting that the stock may be nearing an overbought condition.

On-Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... More (OBV) has been relatively flat, indicating that buying and selling pressures are balanced.

The Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ... More is at 0.812, indicating a strong momentum but also suggesting that the stock could be overbought.

The Average Directional IndexThe Average Directional Index (ADX) stands as a cornerstone indicator in the toolkit of technical traders, offering insights into the strength of market trends. Developed by Welles... More (ADX) is at 24.19, which suggests a moderate trend strength.

The Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati... More is at 48,406, indicating accumulation.

Time-Frame Signals:

3 Months: Buy

6 Months: Hold

12 Months: Hold

Past performance is not an indication of future results. This article should not be considered as investment advice. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions. 🧡

Looking Ahead

Phathom Pharmaceuticals is experiencing a period of robust growth and positive momentum, driven by several key factors. Strong recent performance, optimistic analyst projections, a promising drug pipeline, and positive financial surprises contribute to the stock’s upward trajectory. The upcoming Phase 3 readouts for vonoprazan and its potential market impact further enhance the company’s prospects. With technical indicators signaling continued growth and industry outperformance, Phathom Pharmaceuticals presents a compelling investment opportunity for those looking to capitalize on a rising star in the pharmaceutical sector.

Phathom Pharmaceuticals (PHAT) Stock FAQ

Frequently Asked Questions

- 1. What is the current stock price of Phathom Pharmaceuticals?

- As of July 11, 2024, Phathom Pharmaceuticals’ stock price was $11.32, showing an increase of 8.33%.

- 2. What is the average price target for Phathom Pharmaceuticals according to analysts?

- The average price target is $22.00, which indicates a potential upside of 73.64% from the current price.

- 3. What is the consensus rating for Phathom Pharmaceuticals?

- The consensus rating for Phathom Pharmaceuticals is Strong Buy, based on 4 buy ratings and 1 hold rating from analysts.

- 4. What are the upcoming developments in Phathom Pharmaceuticals’ drug pipeline?

- Phathom Pharmaceuticals is awaiting Phase 3 readouts for its drug vonoprazan, which has shown success in multiple Phase 3 trials overseas and is currently undergoing U.S. trials.

- 5. What is vonoprazan and why is it significant?

- Vonoprazan is a first-in-class potassium-competitive acid blocker (PCAB) and represents the first major innovation in the U.S. erosive GERD market in over 30 years.

- 6. How did Phathom Pharmaceuticals perform in its recent earnings and revenue reports?

- For the quarter ended March 2024, Phathom Pharmaceuticals delivered earnings and revenue surprises of 0.70% and 30.73%, respectively.

- 7. How has Phathom Pharmaceuticals performed compared to its industry?

- Phathom Pharmaceuticals has outperformed its overall industry in the last calendar year.

- 8. What technical indicators suggest a positive outlook for Phathom Pharmaceuticals stock?

- The stock has shown a strong rising trend in the short term and holds buy signals from both short and long-term moving averages.

- 9. What does the Relative Strength (RS) Rating indicate about Phathom Pharmaceuticals?

- Phathom Pharmaceuticals’ RS Rating recently jumped to 86, indicating that it is outperforming 86% of all stocks in terms of price performance over the past year.

- 10. Why might momentum investors be interested in Phathom Pharmaceuticals?

- The improved RS Rating and strong technical indicators may attract momentum investors looking for stocks with strong performance trends.

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.