Palantir Technologies’ stock surged in after-hours trading on August 5, 2024, due to its strong financial performance and positive outlook driven by AI initiatives. The company raised its annual revenue forecast to $2.74-$2.75 billion, surpassing analysts’ expectations of $2.7 billion. Palantir’s second-quarter results exceeded estimates for both revenue and earnings, attributed to the growing demand for its AI software. The company also increased its adjusted operating income forecast to $966-$974 million, up from $882.9 million. Palantir highlighted that its AI capabilities have significantly transformed its business, aligning with the current market interest in AI technologies.

Key Reasons for the Stock Surge

Raised Annual Revenue Forecast

Palantir has revised its annual revenue forecast upward for the second time this year, showcasing strong performance and confidence in its business prospects. The company now projects revenues between $2.74 billion and $2.75 billion, exceeding analysts’ expectations of $2.7 billion. This adjustment reflects the robust demand for Palantir’s services and the company’s strategic initiatives in expanding its market presence.

Strong Quarterly Earnings

The second quarter results exceeded expectations, further boosting investor confidence. Palantir reported quarterly revenue of $678.1 million, surpassing analysts’ predictions of $652.1 million. The company’s financial success is largely attributed to the increasing demand for its AI software, which has proven essential in various sectors, including government and corporate clients.

Increased Profit Outlook

In addition to raising its revenue forecast, Palantir has also elevated its outlook for adjusted operating income to a range of $966 million to $974 million for the year. This is a significant increase from the previously expected $882.9 million. The enhanced profit outlook underscores the company’s efficient operational strategies and the profitability of its AI-driven solutions.

AI Transformation

Palantir’s AI capabilities have been a transformative force for the company, driving substantial growth. The company’s focus on AI has resonated well with investors, particularly given the current market interest in AI technologies. Palantir’s AI platform has been instrumental in meeting the growing demand for AI services, helping businesses test, debug code, and evaluate AI-related scenarios effectively.

Factors Contributing to the Raised Revenue Forecast

Surging Demand for AI Services

The generative AI boom has significantly increased demand for Palantir’s software services from both government and corporate clients. Palantir’s AI platform plays a crucial role in addressing this demand, providing advanced solutions that help clients navigate the complexities of AI development and deployment.

Strong Quarterly Financial Performance

Palantir’s financial performance in the April-to-June period was marked by the company’s largest-ever quarterly profit. The robust financial results have bolstered confidence in Palantir’s growth trajectory and its ability to capitalize on the burgeoning AI market.

Increased Revenue from U.S.-Based Companies

The company has successfully expanded its market share within the United States, raising its annual revenue expectation from U.S.-based companies by $11 million, reaching $672 million. This increase highlights Palantir’s strategic efforts in strengthening its presence in the U.S. market.

Addressing AI Development Bottlenecks

Palantir has been instrumental in helping companies overcome significant bottlenecks between AI application prototypes and finished products ready for deployment. This capability has made Palantir’s services highly valuable to businesses seeking to implement AI solutions effectively and efficiently.

Diversification Beyond Government Clients

While government clients continue to contribute significantly to Palantir’s revenue, the company has made strides in reducing its dependence on this sector. Revenue from corporate clients grew by 33% in the reported quarter, indicating successful diversification efforts and the company’s ability to attract a broader client base.

Insights

- Palantir raised its annual revenue forecast due to strong performance and market demand.

- The company reported record quarterly profits, boosting investor confidence.

- AI capabilities are a major growth driver for Palantir.

- Diversification beyond government clients has been successful, with significant growth from corporate clients.

- Palantir helps companies address AI development bottlenecks, enhancing its service value.

The Essence (80/20)

Core Topics:

- Financial Performance:

- Raised annual revenue forecast to $2.74-$2.75 billion.

- Record quarterly profit with revenue surpassing $678.1 million.

- AI Initiatives:

- AI capabilities have transformed Palantir’s business.

- High demand for AI software from government and corporate clients.

- Market Diversification:

- Increased revenue from U.S.-based companies by $11 million.

- Significant growth from corporate clients, reducing dependence on government contracts.

- Investor Confidence:

- Strong quarterly earnings and raised profit outlook.

- Positive sentiment driven by effective business strategies and market demand.

The Action Plan – What Palantir Will Likely Do Next

Set achievable financial targets and regularly update forecasts based on market conditions.

Leverage AI Capabilities:

Continue to enhance AI software to meet market demands.

Invest in R&D for AI advancements to stay ahead of competitors.

Expand Market Reach:

Focus on increasing market share among corporate clients.

Explore international markets for further diversification.

Strengthen Financial Strategy:

Maintain transparency in financial reporting to boost investor confidence.

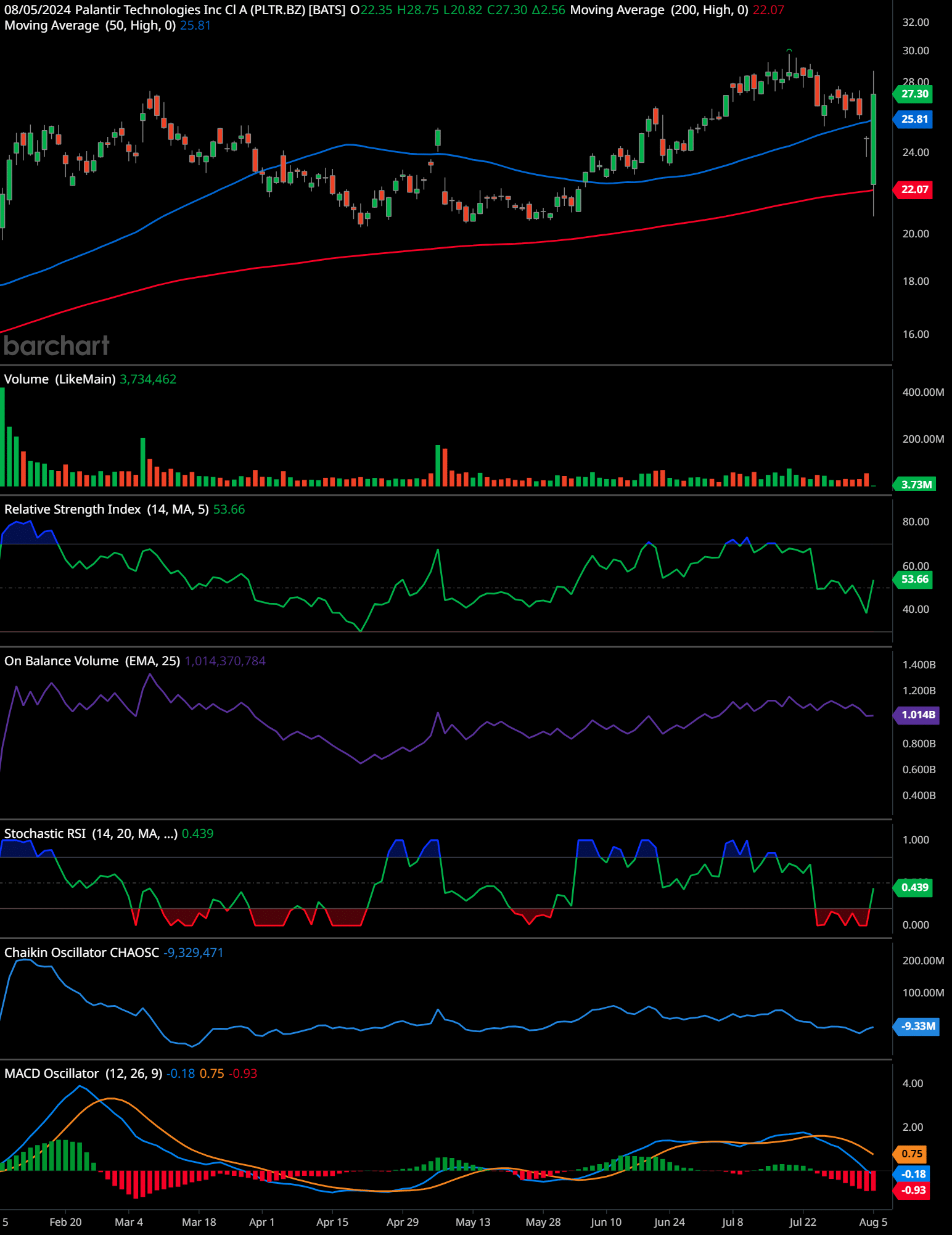

PLTR Technical Analysis Daily Time Frame

The chart for Palantir Technologies Inc (PLTR) shows the following technical indicators and patterns:

Trend Analysis:

- The stock has been in an uptrend since mid-May, reaching a peak near $28 in late July.

- Recently, there has been a correction with the stock dipping below the 50-day moving average (25.81) but finding support above the 200-day moving average (22.07).

Support and Resistance:

- Support: Immediate support at the 200-day moving average (22.07).

- Resistance: The recent high around $28 acts as strong resistance.

Volume:

- The volume shows spikes during major price movements, indicating significant trading interest during these periods.

Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... More (RSI):

- RSI is at 53.66, which is neutral. It suggests neither overbought nor oversold conditions.

On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... More (OBV):

- OBV is stable around 1.014B, showing that the volume flow is relatively consistent and there is no strong divergence from the price trend.

Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ... More:

- Stochastic RSI is at 0.439, indicating it is in a low region but starting to turn up, suggesting a potential move higher if it crosses the midpoint.

Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati... More:

- The Chaikin Oscillator is negative at -9.329M, indicating weak buying pressure or stronger selling pressure.

MACDThe MACD indicator is essentially a momentum indicator that shows the relationship between two different moving averages of price. The MACD is the difference between the 12-period ... More:

- The MACD line is below the signal line with a negative value (-0.18), and the histogram shows increasing red bars, indicating bearish momentum.

Time-Frame Signals:

12 Months: Buy. The longer-term uptrend is still intact. Assuming no significant negative changes in the broader market or company fundamentals, the stock could continue its upward trajectory.

3 Months: Hold. The stock is correcting within an overall uptrend. Wait for further confirmation if the support at the 200-day moving average holds.

6 Months: Buy. If the stock continues to find support and the indicators like RSI and MACD start to show bullish signals, it could present a good buying opportunity.

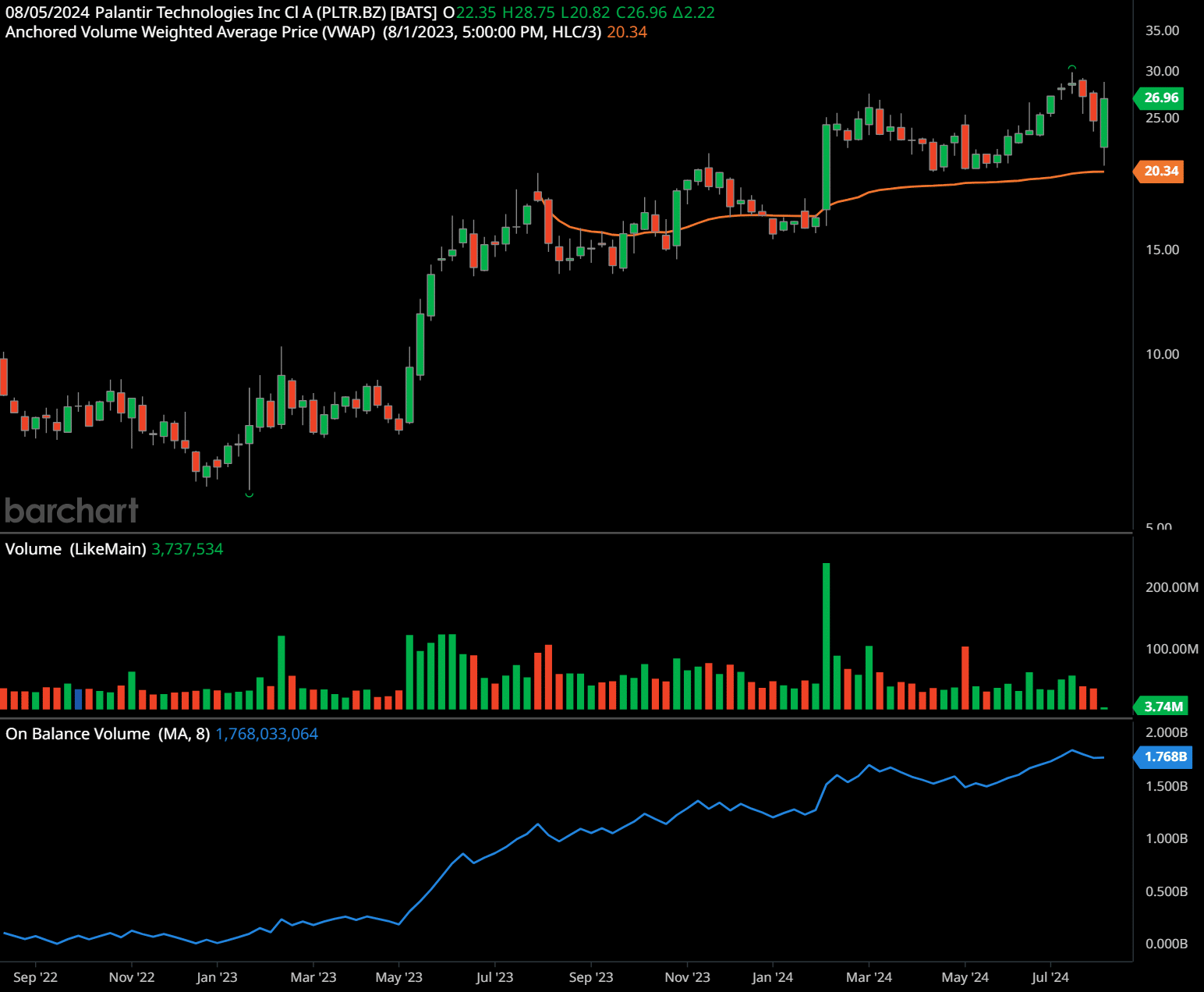

PLTR Technical Analysis Weekly Time Frame

The chart for Palantir Technologies Inc (PLTR) shows the following technical indicators and patterns in the weekly time frame:

Trend Analysis:

- The stock has been in an uptrend since late 2022, with a significant increase in price from around $10 to a high of approximately $30 by mid-2024.

- Recently, the stock has seen a pullback from its highs but remains above the anchored VWAP (20.34) from August 2023.

Support and Resistance:

- Support: The anchored VWAP at 20.34 provides a key support level.

- Resistance: The recent high near $30 acts as a major resistance level.

Volume:

- Volume has seen spikes during major price movements, indicating strong trading activity during these periods.

On Balance Volume (OBV):

- OBV is on an upward trajectory, indicating that the volume on up days is higher than on down days, suggesting accumulation.

Time-Frame Signals:

- 1 Year: Hold. The stock is in a corrective phase within an overall uptrend. Watching how it interacts with the VWAP support level will be crucial.

- 2 Year: Buy. Assuming the uptrend continues and the stock holds above key support levels, it presents a good buying opportunity for longer-term growth.

- 3 Year: Buy. The long-term uptrend remains intact. If the company continues to perform well fundamentally, the stock could continue to appreciate.

Past performance is not an indication of future results and this article should not be considered as investment advice. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions. 🧡

Looking Ahead

Palantir Technologies’ impressive financial performance and strategic focus on AI have positioned the company for continued growth and success. The raised annual revenue forecast, strong quarterly earnings, increased profit outlook, and transformative AI capabilities have collectively contributed to the surge in Palantir’s stock price. As the company continues to innovate and expand its market presence, it remains well-poised to capitalize on the growing demand for AI solutions and drive long-term value for its investors.

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.