On July 31, 2024, Cassava Sciences (SAVA) stock surged by 26.47%, closing at $22.22, driven by several positive developments. Rick Barry, the new Executive Chairman, released an optimistic open letter to stakeholders, which boosted investor confidence. Additionally, the upcoming Phase 3 results of their Alzheimer’s drug, simufilam, expected in December 2024, and the extension of open-label trials by 36 months further fueled the stock’s rise. Despite previous setbacks, including a 40% year-to-date decline and the CEO’s resignation amid investigations, the high patient retention in trials and Barry’s leadership transition contributed to the stock’s partial recovery and renewed investor optimism.

New Executive Chairman’s Open Letter

Rick Barry’s Optimistic Tone

On July 22, 2024, Rick Barry, the newly appointed executive chairman of Cassava Sciences, released an open letter to shareholders, employees, principal investigators, and patients. The letter, characterized by its optimistic yet candid tone, was well-received by investors. Barry’s communication emphasized transparency and a commitment to advancing the company’s Alzheimer’s disease drug, simufilam.

Upcoming Phase 3 Results

Anticipated December 2024 Announcement

Barry announced that Cassava Sciences plans to report results from its first phase 3 study of simufilam in December 2024. This eagerly awaited update has generated significant investor interest. Additionally, a larger second late-stage study is expected to conclude by June 2025, further heightening anticipation and confidence in the company’s research and development efforts.

Expansion of Open-Label Extension Trials

Extending Treatment for Participants

On July 30, 2024, Cassava Sciences announced the expansion of its open-label extension trials for simufilam by up to an additional 36 months. This strategic move allows participants to continue treatment pending the results of ongoing pivotal Phase 3 trials. The extension reflects the company’s commitment to patient care and the potential long-term efficacy of simufilam.

High Patient Retention

Indicative of Drug Potential

Approximately 89% of patients in Cassava’s ongoing Phase 3 program have elected to continue with open-label treatment with simufilam after completing the blinded trials. This high retention rate suggests strong patient satisfaction and the potential effectiveness of the drug. Such data points bolster investor confidence and underscore the promising prospects for simufilam.

Recovery from Previous Setbacks

Stock’s Partial Rebound

The recent rise in Cassava Sciences’ stock also represents a partial recovery from earlier declines. Despite the gains, Cassava’s stock was still down more than 40% year-to-date as of July 22, 2024. The recovery highlights the volatility often associated with biotech stocks, especially those with drugs in late-stage clinical trials.

Market Reaction

Renewed Investor Confidence

As of July 31, 2024, at market close, Cassava Sciences stock (SAVA) was up 26.47% to $22.22. This significant increase reflects renewed investor confidence in the company’s prospects, driven by positive developments and encouraging statements from the new leadership.

The Impact of CEO Resignation

Immediate Stock Decline

The resignation of Cassava Sciences’ CEO, Remi Barbier, on July 17, 2024, had a significant negative impact on the company’s stock. Following the announcement, Cassava Sciences’ stock (SAVA) experienced a sharp decline, plunging by around 29-31% on the day of the announcement.

Context of Resignation

Barbier’s resignation occurred amid ongoing investigations by the U.S. Department of Justice (DOJ) and the Securities and Exchange Commission (SEC) into allegations of scientific misconduct related to Cassava’s Alzheimer’s drug, simufilam. This added to the uncertainty and negative sentiment surrounding the company, exacerbating concerns about its stability and transparency.

Leadership Transition

In response to Barbier’s resignation, Richard Barry, a member of Cassava’s board since 2021, was appointed as the interim CEO and executive chairman. This leadership change was part of a broader effort to enhance corporate governance and transparency. However, the market reacted negatively to the leadership change and the broader context of regulatory scrutiny.

Insights:

- Leadership changes can significantly impact investor sentiment.

- High patient retention rates may indicate drug efficacy and patient satisfaction.

- Regulatory investigations can create significant volatility in biotech stocks.

The Essence (80/20)The Origins and Evolution of the 80/20 Principle The Discovery by Vilfredo Pareto In 1897, Italian economist Vilfredo Pareto uncovered a striking pattern in his study of wealth and... More:

- Leadership Impact: Rick Barry’s appointment and his open letter restored investor confidence.

- Drug Development Progress: Upcoming Phase 3 results and extended trials for simufilam are crucial.

- Market Volatility: Previous declines and CEO resignation due to investigations affected stock stability.

The Guerilla Stock Trading Action Plan:

- Monitor Leadership Communications: Track announcements from Rick Barry and other executives for further insights.

- Phase 3 Trial Updates: Keep an eye on the results expected in December 2024 and June 2025.

- Regulatory Developments: Stay informed about ongoing DOJ and SEC investigations.

Blind Spots and Actions to Remediate

Overreliance on Leadership Confidence:

Action: Diversify sources of information by seeking independent analyses and expert opinions on the company’s progress and potential challenges.

Regulatory Risks:

Action: Stay updated on the DOJ and SEC investigations. Consider the implications of regulatory outcomes and prepare contingency plans for adverse findings.

Trial Result Uncertainty:

Action: Continuously monitor trial updates and interim results. Analyze peer-reviewed publications and expert assessments of simufilam’s efficacy and safety data.

Market Volatility:

Action: Implement risk management strategies, such as setting stop-loss orders and diversifying your investment portfolio to mitigate potential losses from sudden stock price fluctuations.

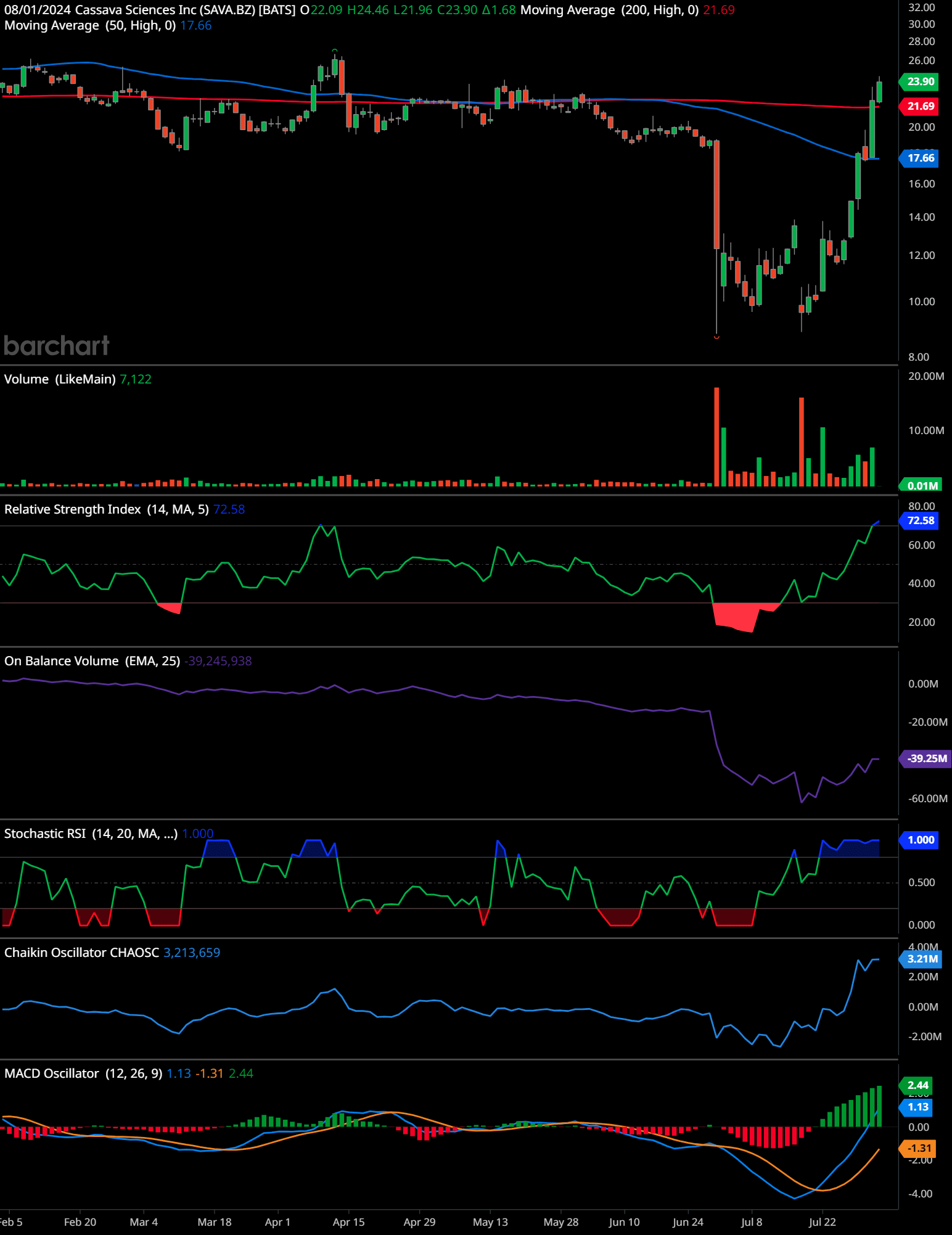

SAVA Technical Analysis Daily Time Frame

The chart for Cassava Sciences Inc. (SAVA) shows several key technical elements and indicators. Here’s the analysis:

Price Movement:

- The stock has recently broken above both the 50-day moving average (17.66) and the 200-day moving average (21.69).

- The price has surged from a low near 8 in May to the current level of 23.90, indicating a strong upward trend.

Volume:

- Volume has increased significantly during the recent upward movement, suggesting strong buying interest.

Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... More (RSI):

- The RSI is at 72.58, which is above the overbought threshold of 70. This indicates that the stock might be overbought and due for a potential pullback.

On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... More (OBV):

- The OBV is starting to rise after a prolonged downtrend, indicating that accumulation is beginning to outpace distribution.

Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ... More:

- The Stochastic RSI is at 1.000, which is in the overbought territory, suggesting the potential for a near-term correction.

Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati... More:

- The Chaikin Oscillator is at 3,213,659, showing a positive trend and confirming strong buying pressure.

MACDThe MACD indicator is essentially a momentum indicator that shows the relationship between two different moving averages of price. The MACD is the difference between the 12-period ... More (Moving Average Convergence Divergence):

- The MACD line is above the signal line, with values of 1.13 (MACD) and -1.31 (Signal), indicating a bullish crossover. The histogram also supports bullish momentum.

Time-Frame Signals:

3 Months:

Recommendation: Hold. The stock has shown significant upward momentum, but indicators like RSI and Stochastic RSI suggest it may be overbought and could see a short-term pullback. Holding would allow investors to benefit from any continued upward movement while being cautious of potential corrections.

6 Months:

Recommendation: Buy. The strong breakout above the moving averages and increasing volume suggests sustained bullish momentum. Any short-term pullbacks could provide good entry points for a continued uptrend.

12 Months:

Recommendation: Buy. The positive long-term indicators such as the rising OBV and MACD crossover support a bullish outlook for the next year. The stock’s recent performance indicates potential for continued growth.

Overall, the technical indicators suggest a strong upward trend with potential for short-term corrections, making it a good candidate for medium to long-term investment.

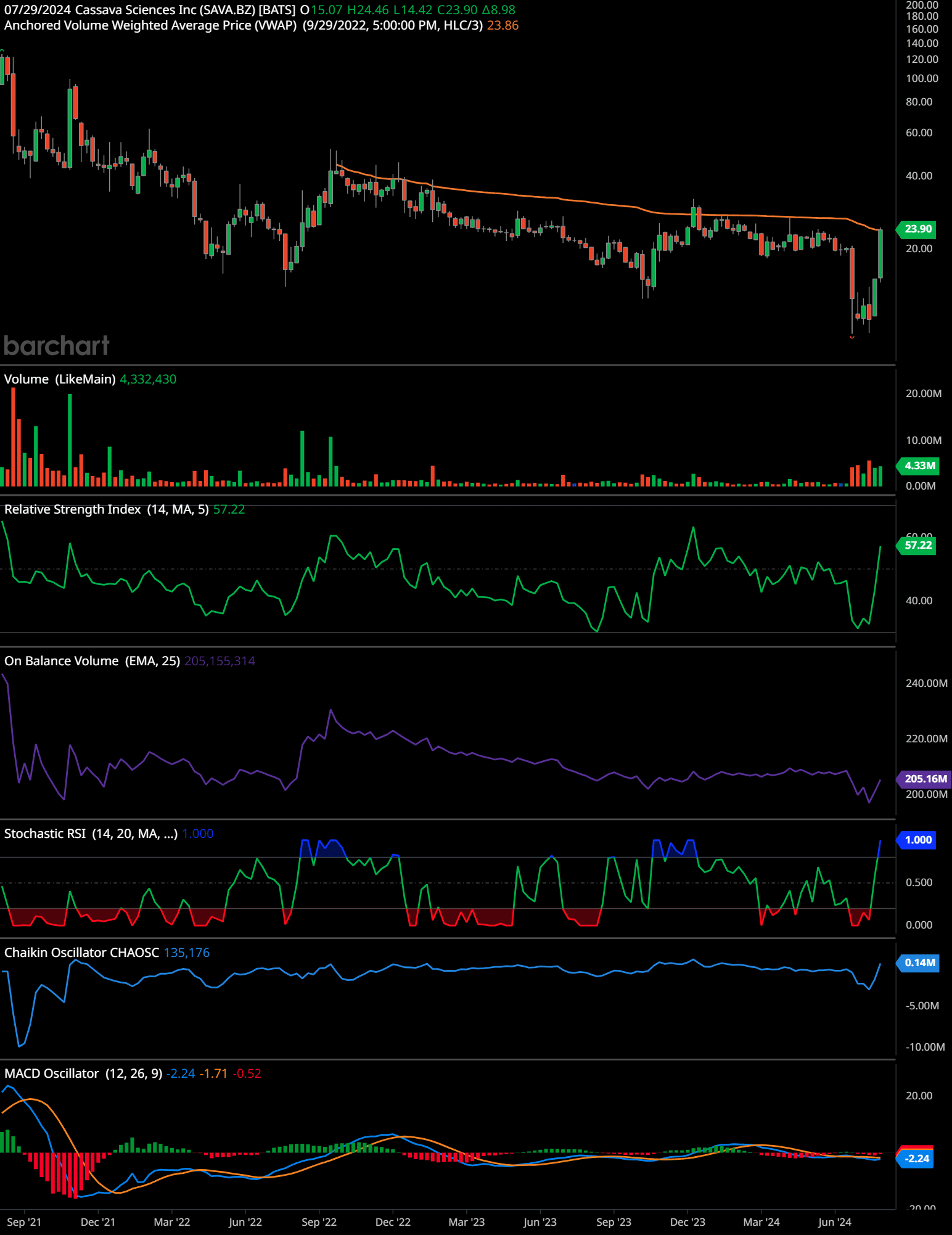

SAVA Technical Analysis Daily Weekly Frame

The weekly chart for Cassava Sciences Inc. (SAVA) provides the following technical insights:

Price Movement:

- The stock has recently rebounded from a low near 14, moving up to 23.90.

- It has crossed above the Anchored VWAP at 23.86, indicating a potential change in trend.

Volume:

- Volume has increased notably during the recent upward movement, suggesting renewed buying interest.

Relative Strength Index (RSI):

- The RSI is at 57.22, which is in the neutral zone. This suggests there is room for further upward movement without being overbought.

On Balance Volume (OBV):

- OBV remains in a downtrend but is showing signs of flattening out, which may indicate the end of the distribution phase.

Stochastic RSI:

- The Stochastic RSI is at 1.000, indicating an overbought condition, suggesting the potential for a near-term pullback.

Chaikin Oscillator:

- The Chaikin Oscillator is at 135,176, showing a recent positive trend, supporting the bullish sentiment.

MACD (Moving Average Convergence Divergence):

- The MACD line is still below the signal line with values of -2.24 (MACD) and -1.71 (Signal), indicating the bearish trend is not fully reversed. However, the histogram shows diminishing bearish momentum.

Time-Frame Signals:

1 Year:

Recommendation: Hold. The recent rebound and break above the Anchored VWAP suggest a potential change in trend. Holding would allow investors to observe if the bullish momentum sustains and confirm the trend reversal.

2 Years:

Recommendation: Buy. The indicators suggest the stock may have reached a bottom and is starting to recover. The increasing volume and positive Chaikin Oscillator support a medium-term bullish outlook.

3 Years:

Recommendation: Buy. If the current trend continues, the stock has significant upside potential over the long term. The historical low provides a good entry point for long-term investors.

Past performance is not an indication of future results. This article should not be considered as investment advice. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions. 🧡

Looking Ahead

The rise in Cassava Sciences’ stock on July 31, 2024, was driven by positive developments and optimistic statements from new leadership. However, the company continues to face challenges, including ongoing investigations and recent executive departures. The ultimate success of Cassava Sciences hinges on the results of its ongoing Phase 3 trials for simufilam. Investors should remain cautious, as biotech stocks, especially those in late-stage clinical trials, can be highly volatile.

Frequently Asked Questions about Cassava Sciences (SAVA) Stock

1. Why did Cassava Sciences (SAVA) stock rise significantly on July 31, 2024?

The stock saw a significant increase due to positive developments and optimistic statements from the company’s new leadership, including an open letter from the new executive chairman and announcements about upcoming Phase 3 results.

2. What did Rick Barry, the new executive chairman, announce in his open letter?

Rick Barry’s open letter, released on July 22, 2024, was well-received by investors for its optimistic yet candid tone. He addressed shareholders, employees, principal investigators, and patients.

3. When are the results of the first Phase 3 study of simufilam expected?

Cassava Sciences plans to report results from its first Phase 3 study of simufilam in December 2024.

4. What is the timeline for the second late-stage study of simufilam?

The second late-stage study of simufilam is expected to conclude by June 2025.

5. What recent expansion did Cassava Sciences announce regarding their trials?

On July 30, 2024, Cassava Sciences announced the expansion of its open-label extension trials for simufilam by up to an additional 36 months.

6. What is the patient retention rate in Cassava’s Phase 3 program?

Approximately 89% of patients in Cassava’s ongoing Phase 3 program have elected to continue with open-label treatment with simufilam after completing the blinded trials.

7. How did the stock performance on July 31, 2024, compare to the year-to-date performance?

Despite the gains on July 31, 2024, Cassava’s stock was still down more than 40% year-to-date as of July 22, 2024.

8. What was the market reaction to Cassava Sciences’ stock on July 31, 2024?

As of market close on July 31, 2024, Cassava Sciences stock (SAVA) was up 26.47% to $22.22, reflecting renewed investor confidence in the company’s prospects.

9. What contributed to the significant drop in Cassava Sciences’ stock following the CEO’s resignation?

The resignation of CEO Remi Barbier on July 17, 2024, amid ongoing investigations by the DOJ and SEC into allegations of scientific misconduct, led to a sharp decline in the stock by around 29-31%.

10. Who is the interim CEO of Cassava Sciences?

Richard Barry, a member of Cassava’s board since 2021, was appointed as the interim CEO and executive chairman while the company searches for a permanent CEO.

11. What broader efforts are being made in the leadership transition at Cassava Sciences?

The leadership change, including the appointment of Richard Barry as interim CEO, is part of a broader effort to enhance corporate governance and transparency.

12. How has the market reacted to the broader context of regulatory scrutiny at Cassava Sciences?

The market reacted negatively not only to the leadership change but also to the broader context of regulatory scrutiny and the departure of other key executives.

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.