Months after receiving $8.5 billion in federal grants to boost U.S. chipmaking, Intel announced it will cut 15% of its workforce, or around 17,000 jobs, as part of a significant cost-cutting and restructuring plan. CEO Pat Gelsinger cited the need to align the company’s cost structure with its new operating model and address higher costs and lower margins. Intel’s second-quarter financial results for 2024 were poor, with a net revenue of $12.8 billion and a net loss of $1.61 billion. The company forecasts further financial difficulties in the upcoming quarter and intense competition from companies like AMD and Nvidia. The market sentiment around Intel has been negative, and the job cuts, following the federal grants, have raised concerns about the company’s stability and the fairness of such decisions. The CHIPS and Science Act, aimed at enhancing U.S. semiconductor manufacturing, provided these grants to strengthen competition with China.

Significant Restructuring Efforts

CEO’s Statement on Workforce Reduction

Intel CEO Pat Gelsinger addressed employees, acknowledging the difficulty of the decision. He emphasized the need to align the company’s cost structure with a new operating model, stating, “Simply put, we must align our cost structure with our new operating model and fundamentally change the way we operate.” Gelsinger admitted that revenues had not met expectations and highlighted the pressing need to address high costs and low margins.

Financial Challenges and Revenue Shortfall

Intel’s second-quarter financial results for 2024 were disappointing, with a net revenue of $12.8 billion, falling short of analyst expectations of $12.94 billion. The company reported a net loss of $1.61 billion for the quarter, a significant decline from the $1.48 billion net income in the same quarter the previous year. Adjusted earnings per shareEarnings per share (EPS) is a fundamental financial metric that provides valuable insights into a company's profitability. This widely used indicator helps investors and analysts g... More were only 2 cents, well below the expected 10 cents.

Gloomy Forecast and High Costs

Revenue Projections and Margins

Intel’s forecast for the upcoming quarter was also bleak, with an expected revenue of $13.0 billion, significantly below the consensus estimates of $14.4 billion. The adjusted gross marginGross margin is a critical financial metric that plays a pivotal role in evaluating a company's financial health and profitability. It is a percentage that indicates how efficientl... More is anticipated to remain low at 38%, reflecting ongoing cost challenges. The company’s transition to new production facilities and the high costs associated with ramping up new manufacturing processes have further strained profitability.

Massive Layoffs and Cost Control

To control costs, Intel announced the reduction of approximately 15,000 jobs, about 15% of its global workforce. This move is part of a broader strategy to reduce operating expenses and align the company’s cost structure with its new operating model. However, such significant layoffs have raised concerns among investors about the company’s stability and future growth prospects.

Competitive Pressures and Market Impact

Intense Industry Competition

Intel is facing intense competition in the semiconductor industry, particularly from companies like AMD and Nvidia. The competitive landscape has made it difficult for Intel to maintain its market share and pricing power, especially in the high-performance computing and AI segments. The company’s efforts to transition to leading-edge chip manufacturing have not yet yielded the expected benefits, further exacerbating investor concerns.

Broader Market Impact

Intel’s disappointing earnings and strategic challenges have had a ripple effect on the broader semiconductor market. Other major chip stocks, such as Nvidia, TSMC, and Samsung, also saw declines following Intel’s earnings report. This broader market reaction has amplified the negative sentiment surrounding Intel’s stock.

Market Sentiment and Analyst Downgrades

Negative Market Sentiment

The market sentiment around Intel has been largely negative, with analysts cutting their fair value estimates for the stock. For instance, Morningstar reduced its fair value estimate for Intel from $30 to $21 per share, citing concerns about the company’s competitive positioning and profitability.

Federal Subsidies and Workforce Reductions

The decision to cut jobs after receiving substantial federal funds has sparked controversy. “Making Money” host Charles Payne expressed his frustration, questioning the logic and fairness of the decision. The semiconductor giant received federal subsidies under the Biden administration’s CHIPS and Science Act, signed into law in 2022, to advance semiconductor manufacturing projects in the U.S.

CHIPS and Science Act and Intel’s Challenges

Federal Support for Semiconductor Manufacturing

The bipartisan CHIPS and Science Act aims to improve competition with China by strengthening U.S. manufacturing, supply chains, and national security, and investing in research and development. The act allocated more than $52 billion for U.S. semiconductor research, development, manufacturing, and workforce development.

Adjusting to Market Conditions

In an interview with The Wall Street Journal, Gelsinger noted that market conditions necessitated financial adjustments. He acknowledged the unexpected surge in demand for AI chips and its impact on Intel’s sales. The demand for AI chips from companies like Nvidia has shifted away from non-AI products, reducing Intel’s sales by 1% to $12.8 billion, resulting in a $1.6 billion loss compared to a $1.5 billion profit in the prior quarter.

Insights

- Intel’s restructuring aims to address financial and operational challenges.

- The company’s poor financial performance highlights significant industry pressures.

- Federal grants have not yet stabilized Intel’s market position.

The Essence (80/20)

Intel is undergoing significant restructuring due to financial challenges and intense competition. Despite federal grants aimed at boosting U.S. chipmaking, Intel has announced major layoffs and poor financial results. The company must realign its cost structure and operations to improve profitability and market standing.

The Action Plan – What Intel Will Likely Do Next

Transparency: Maintain open communication with stakeholders to rebuild trust.

Cost Management: Implement stringent cost control measures to align with the new operating model.

Operational Efficiency: Streamline operations to reduce overhead and improve margins.

Market Adaptation: Focus on high-demand segments like AI to regain market share.

Blind Spots with Remediation Actions

Employee Morale and Productivity

- Blind Spot: The significant layoffs could severely impact employee morale and productivity, leading to a decline in overall performance and innovation.

- Action: Implement a comprehensive employee support program, including counseling services, career development opportunities, and regular communication from leadership to reassure and motivate remaining staff.

Long-Term Innovation Capacity

- Blind Spot: Focusing on cost-cutting may undermine long-term investment in research and development, affecting Intel’s ability to innovate and stay competitive.

- Action: Allocate a portion of savings from restructuring towards R&D initiatives, ensuring continuous innovation and development of cutting-edge technologies.

Customer and Market Trust

- Blind Spot: Job cuts and financial instability may erode customer confidence and market trust, potentially leading to loss of business and market share.

- Action: Enhance customer engagement through transparent communication about Intel’s strategic plans, emphasizing commitment to quality and reliability, and provide assurances about product and service continuity.

Regulatory and Public Perception

Blind Spot: The decision to cut jobs after receiving substantial federal grants may attract negative regulatory scrutiny and public criticism, affecting Intel’s reputation.

Action: Proactively engage with regulators and the public by explaining the necessity of the job cuts for long-term sustainability, and demonstrate how Intel is using the grants to support U.S. manufacturing and innovation goals.

Intel is a ‘broken company,’ its decline is a ‘death spiral moment’: Gregg Smith

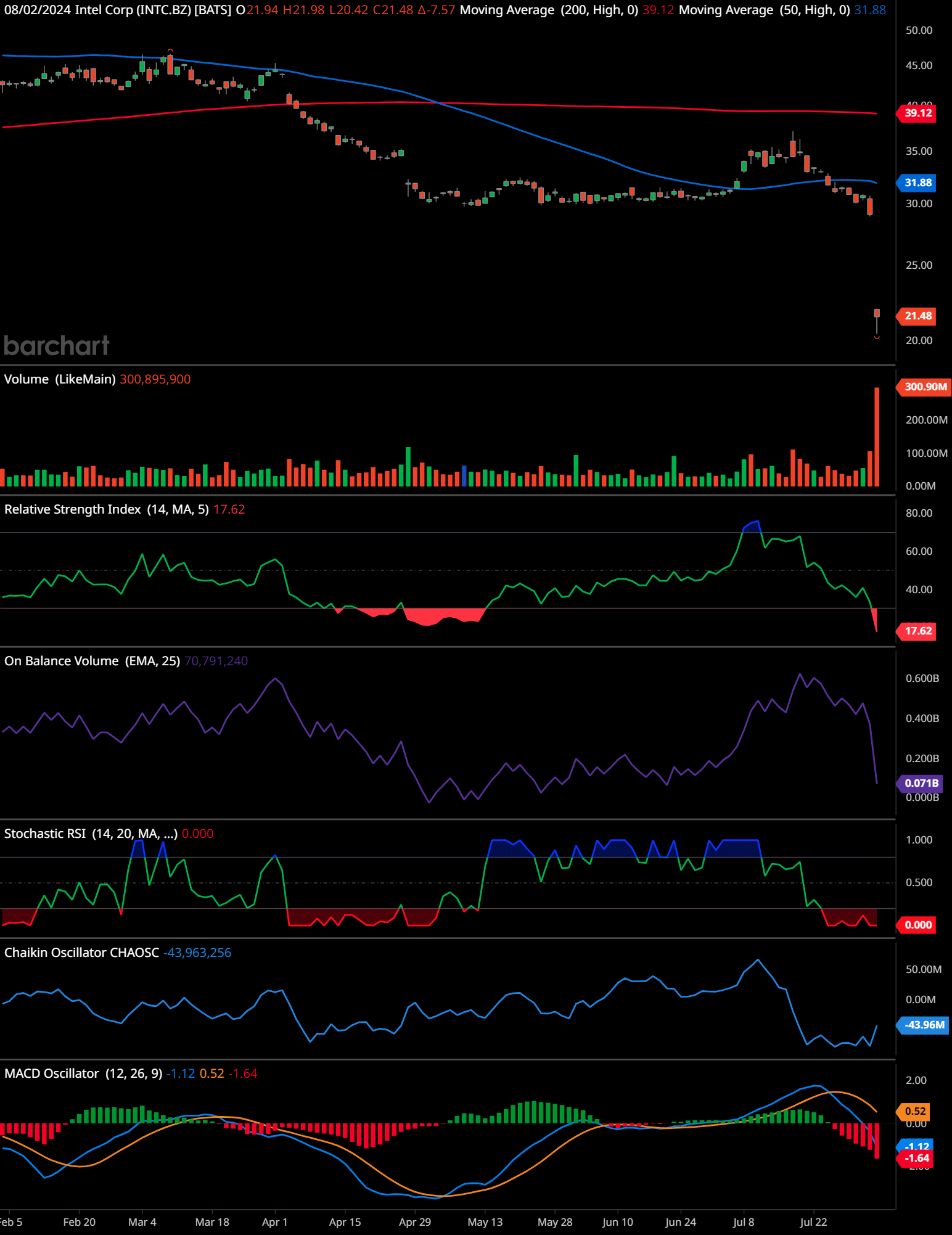

INTC Technical Analysis Daily Time Frame

For the provided daily chart of Intel Corp (INTC), here is a comprehensive technical analysis:

Trend Analysis:

The stock is in a significant downtrend, as indicated by the 50-day moving average (31.88) being below the 200-day moving average (39.12), a classic bearish signal. The stock price has recently experienced a sharp decline, closing at 21.48, which is well below both moving averages.

Volume Analysis:

The volume is spiking significantly, with the latest volume at 300.90 million shares, which suggests strong selling pressure. This high volume on a down day typically confirms the bearish sentiment.

Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... More (RSI):

The RSI is at 17.62, indicating that the stock is extremely oversold. An RSI below 30 is considered oversold, and below 20 is very rare, suggesting that there may be a potential for a short-term bounce, although it does not signal an immediate reversal.

On-Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... More (OBV):

The OBV has been trending downwards, indicating that the volume on down days has been higher than on up days. This supports the bearish trend.

Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ... More:

The Stochastic RSI is at 0.000, which confirms the oversold condition noted in the RSI. This extreme value suggests a high potential for a short-term reversal or at least a temporary relief rally.

Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati... More:

The Chaikin Oscillator is at -43.96M, showing a significant outflow of money from the stock. This supports the bearish trend and indicates that investors are pulling their money out of the stock.

MACDThe MACD indicator is essentially a momentum indicator that shows the relationship between two different moving averages of price. The MACD is the difference between the 12-period ... More Oscillator:

The MACD line (-1.12) is below the signal line (-1.64), and both are in negative territory. This is a bearish signal, indicating downward momentum. The histogram also shows a negative value, suggesting increasing bearish momentum.

Support and Resistance Levels:

The stock has broken through several support levels, and the next major support level is around 20.00. The resistance levels to watch are the 50-day moving average at 31.88 and the 200-day moving average at 39.12.

Time-Frame Signals:

3-Month Signal: Sell. The strong downtrend, high volume on the down days, and extremely oversold conditions suggest continued bearish pressure in the short term.

6-Month Signal: Hold. The extreme oversold condition indicated by both the RSI and Stochastic RSI might lead to a potential rebound, but the overall trend remains bearish.

12-Month Signal: Hold. The stock needs to show signs of stabilization and reversal, but the current indicators do not provide a clear long-term reversal signal yet.

Overall, the analysis indicates a strong bearish trend with potential short-term oversold conditions that may lead to a temporary bounce, but the overall outlook remains negative.

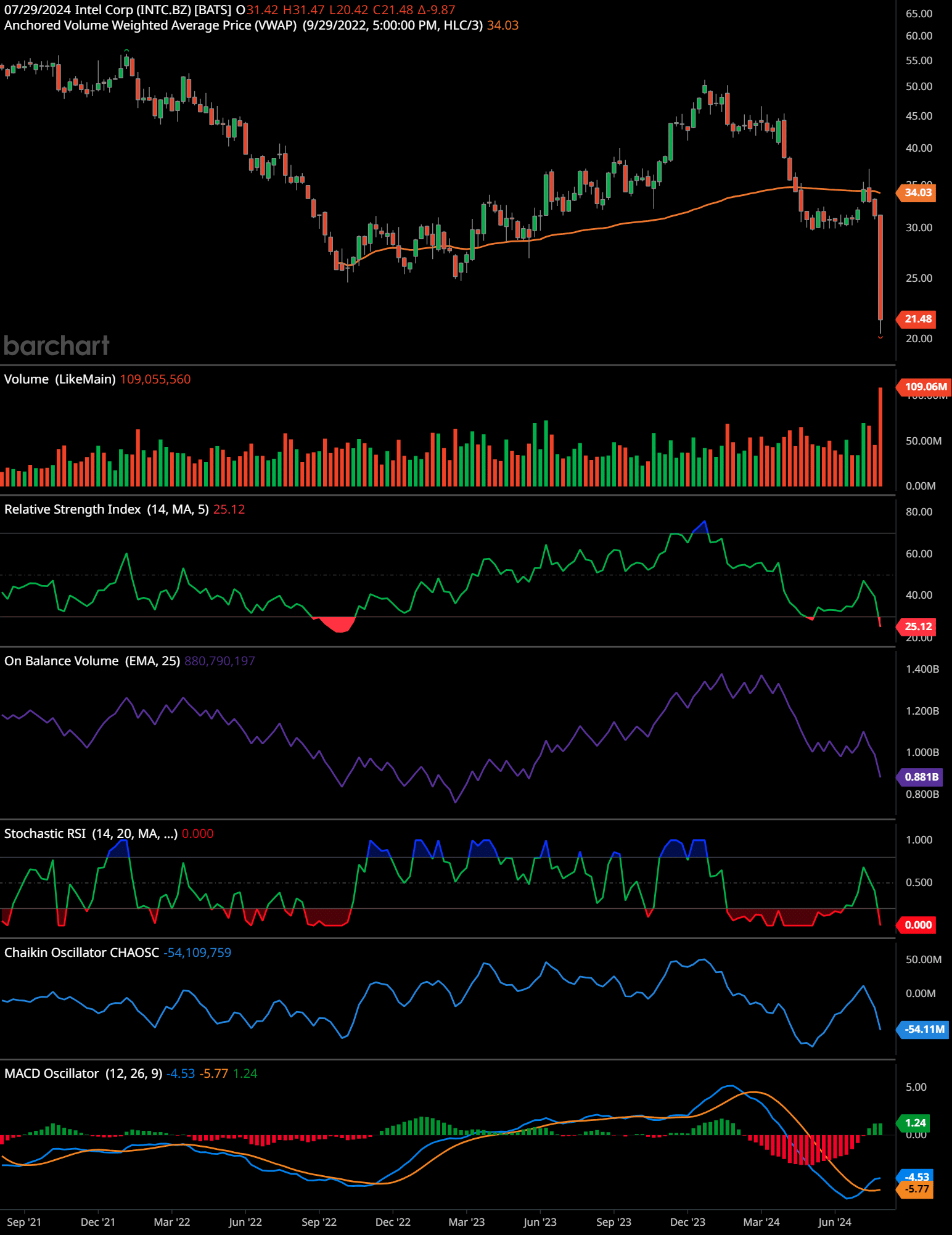

INTC Technical Analysis Weekly Time Frame

The provided chart shows the weekly performance of Intel Corp (INTC) over a few years.

Analyzing the major trends, there is a significant downward trend from around $55 in September 2021 to the current price of approximately $21.48 in late July 2024. The stock experienced a brief upward movement starting in October 2022, peaking around $40 in March 2023, followed by another sharp decline.

Support and resistance levels can be identified. Major support is around the $21-$22 level, which aligns with the current price. Resistance levels are found around $34, corresponding to the anchored VWAP from September 2022.

Key indicators:

- Volume: High volume in recent weeks indicates strong selling pressure.

- RSI (Relative Strength Index): Currently at 25.12, indicating the stock is in oversold territory.

- On-Balance Volume (OBV): Downward trend confirms selling pressure.

- Stochastic RSI: At 0, confirming the oversold condition.

- Chaikin Oscillator: Negative, suggesting a bearish outlook.

- MACD (Moving Average Convergence Divergence): Shows a bearish crossover with the MACD line below the signal line, further indicating bearish momentum.

Time-Frame Signals:

1 year: Given the strong downward momentum, oversold conditions, and bearish indicators, the outlook for the next year is bearish. Short-term traders might consider a “Sell” signal or “Hold” if already positioned until a clearer reversal signal is observed.

2 year: Over the next two years, there may be some recovery potential if the stock finds strong support around $21 and manages to stabilize. However, the overall outlook remains cautious with a preference towards “Hold” to observe further developments.

3 year: In three years, the stock might recover if it can form a base and initiate a new upward trend. The long-term outlook is slightly optimistic, suggesting a “Hold” or “Buy” signal if significant positive changes occur in fundamentals or market conditions.

Past performance is not an indication of future results. This article should not be considered as investment advice. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions. 🧡

Looking Ahead

Intel’s recent workforce reductions and restructuring efforts reflect the company’s struggle to navigate financial challenges and intense industry competition. As the semiconductor giant adapts to changing market dynamics and adjusts its operating model, the impact of these decisions will be closely watched by investors and industry analysts. The company’s commitment to transparency and respect during this transitional period will be crucial as it strives to regain stability and drive future growth.

Frequently Asked Questions about Intel Job Cuts and Restructuring

- Why is Intel cutting 15% of its workforce?

- Intel is cutting 15% of its workforce as part of a massive cost-cutting and restructuring plan to align its cost structure with its new operating model and address financial challenges.

- How many jobs is Intel cutting?

- Intel is cutting around 17,000 jobs, which is approximately 15% of its global workforce.

- What did Intel’s CEO say about the job cuts?

- Intel CEO Pat Gelsinger described the job cuts as some of the most consequential changes in the company’s history, emphasizing the need to align costs with the new operating model and fundamentally change operations.

- What were Intel’s financial results for the second quarter of 2024?

- Intel reported a net revenue of $12.8 billion, which was below analyst expectations, and a net loss of $1.61 billion. The adjusted earnings per share were only 2 cents.

- What is Intel’s forecast for the upcoming quarter?

- Intel expects revenue of $13.0 billion for the upcoming quarter, significantly below the consensus estimates of $14.4 billion. The adjusted gross margin is anticipated to remain low at 38%.

- How has the market reacted to Intel’s earnings and restructuring plans?

- Intel’s disappointing earnings and restructuring plans have led to declines in other major chip stocks like Nvidia, TSMC, and Samsung, amplifying negative sentiment around Intel’s stock.

- How has Intel’s competitive positioning affected its performance?

- Intel is facing intense competition from companies like AMD and Nvidia, making it difficult to maintain market share and pricing power, particularly in high-performance computing and AI segments.

- Why did Intel receive federal subsidies?

- Intel received federal subsidies under the Biden administration’s CHIPS and Science Act to advance semiconductor manufacturing projects in the U.S. and improve competition with China.

- What is the CHIPS and Science Act?

- The CHIPS and Science Act is a bipartisan legislation aimed at strengthening U.S. semiconductor manufacturing, supply chains, national security, and investing in research and development. It allocated over $52 billion for these purposes.

- How has demand for AI chips impacted Intel’s sales?

- Increased demand for AI chips from companies like Nvidia has shifted away from non-AI products, reducing Intel’s sales by 1% to $12.8 billion and contributing to a net loss.

- What have analysts said about Intel’s stock value?

- Analysts have largely cut their fair value estimates for Intel’s stock, citing concerns about the company’s competitive positioning and profitability. For instance, Morningstar reduced its fair value estimate from $30 to $21 per share.

- What are the broader implications of Intel’s restructuring for the semiconductor market?

- Intel’s restructuring and financial challenges have had a ripple effect on the broader semiconductor market, leading to declines in other major chip stocks and raising concerns about the industry’s stability.

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.