Woodside Energy’s (WDS) stock has been on an upward trajectory, driven by a confluence of favorable factors. These factors include rising global oil prices, strategic project developments, strong financial performance, attractive valuation, and a competitive dividend yield. Analysts are optimistic about the company’s future, projecting moderate growth over the next several years. This blog post will delve into the key drivers behind Woodside Energy’s rising stock price and provide an overview of its future prospects.

The Impact of Rising Oil Prices

One of the primary reasons behind the recent increase in Woodside Energy’s stock price is the global rise in oil prices. The energy market has witnessed a significant uptick in Brent crude oil prices, which has a direct positive impact on oil and gas companies like Woodside. As a major player in the energy sector, Woodside benefits from higher energy prices, which translate into increased revenue and profitability.

The global oil market has been influenced by various factors, including geopolitical tensions, supply chain disruptions, and production cuts by major oil-producing countries. These factors have contributed to the tightening of supply and the subsequent rise in oil prices. For Woodside, this has created an environment where the company can capitalize on its existing assets and generate higher returns for shareholders.

Strategic Project Developments

Woodside Energy has achieved significant milestones in its strategic projects, further boosting investor confidence and contributing to the rise in its stock price. One of the most notable developments is the first oil production from the Sangomar field, located offshore Senegal. This achievement marks a key milestone for the company and is expected to generate substantial shareholder value.

The Sangomar field is a critical asset in Woodside’s portfolio, and its successful development underscores the company’s ability to execute large-scale projects. The field’s production is expected to ramp up in the coming years, providing a steady stream of revenue and enhancing the company’s overall financial performance. This development has positioned Woodside as a leader in the West African oil market, further strengthening its global presence.

Strong Financial Performance

Woodside’s strong financial performance has been a significant driver of its rising stock price. The company has reported impressive financial results, including increased production and revenue. The recent merger with BHP’s petroleum assets has further bolstered Woodside’s balance sheetThe balance sheet is a snapshot of a company's financial position at a specific point in time. It shows the company's assets, liabilities, and equity. More, providing the company with enhanced financial flexibility and increased cash flowThe cash flow statement provides a detailed overview of the cash inflows and outflows of a company over a specified period of time. It includes cash received from operations, inves... More.

The merger has allowed Woodside to expand its operational footprint and diversify its portfolio, making it one of the largest independent energy companies globally. This strategic move has not only strengthened the company’s financial position but has also created synergies that are expected to drive future growth. Investors have responded positively to these developments, with Woodside’s stock reflecting the company’s robust financial health.

Attractive Valuation

Despite the challenges faced by the energy sector, Woodside Energy’s stock is considered to be trading at a discount compared to its global peers. This relative undervaluation makes it an attractive option for investors seeking potential upside. The company’s strong project pipeline, including long-term initiatives like the Scarborough offshore LNG project, offers significant growth potential.

The Scarborough project, in particular, is a cornerstone of Woodside’s future growth strategy. It is one of the largest undeveloped gas resources in the world, and its development is expected to create substantial value for the company. As Woodside progresses with this project, its stock is likely to attract more attention from investors, further driving its price upwards.

Competitive Dividend Yield

Woodside Energy’s dividend yield is another factor contributing to its rising stock price. The company has a long history of paying dividends, which is particularly appealing to income-focused investors. Even as Woodside invests in future growth projects, its commitment to returning value to shareholders remains strong.

The current dividend yield offered by Woodside is competitive within the energy sector, providing a stable income stream for investors. This yield, combined with the company’s growth prospects, makes Woodside an attractive investment option for those looking to balance income with capital appreciation.

Future Analyst Projections

Analysts have a positive outlook on Woodside Energy’s future, with projections indicating moderate growth over the next several years. For 2024, analysts anticipate a growth of around 10%, driven by the expansion of Woodside’s liquefied natural gas (LNG) production capacity. This expansion is expected to lead to increased productivity and potentially higher profit marginsIn the dynamic world of business, profitability is a fundamental metric that encapsulates a company's ability to generate earnings from its operations. Profit margins, expressed as... More.

In 2025, the stock is projected to grow by approximately 11%. Woodside may capitalize on enhanced production capabilities and explore new markets, particularly in Asia, which could drive investor interest and increase stock value. The company’s focus on sustainable practices and potential investments in renewable energy projects could further attract environmentally conscious investors.

Looking ahead to 2026, a continued upward trend is expected, with a growth rate of 12%. By 2029, analysts project a growth rate of 15%, with potential expansions into offshore wind energy projects and partnerships with technology firms to develop advanced energy management systems.

Overall, analysts have a consensus rating of “Moderate Buy” for Woodside Energy, reflecting positive sentiment towards the company’s future growth prospects. However, it is important to note that stock market predictions are inherently uncertain and subject to various economic and market conditions.

Insights:

- Rising oil prices are a major contributor to Woodside’s stock price increase.

- Strategic projects like Sangomar and Scarborough are key growth drivers.

- The merger with BHP’s petroleum assets has strengthened Woodside’s financial position.

- Woodside’s attractive valuation and dividend yield make it appealing to investors.

- Analysts project steady growth for Woodside, with a focus on LNG and renewable energy.

The Essence (80/20)The Origins and Evolution of the 80/20 Principle The Discovery by Vilfredo Pareto In 1897, Italian economist Vilfredo Pareto uncovered a striking pattern in his study of wealth and... More:

- Core Topics: Rising Oil Prices, Strategic Developments, Strong Financial Performance, Attractive Valuation, Dividend Yield.

- Detailed Descriptions: The rise in global oil prices directly benefits Woodside, a key player in the energy sector. Strategic milestones like the first oil from the Sangomar field and long-term projects like Scarborough LNG are crucial for future growth. The merger with BHP has significantly strengthened Woodside’s financials, making it more appealing to investors. Despite challenges, Woodside’s stock is attractively valued, and its solid dividend yield adds to its allure. Future growth is expected, driven by LNG expansion and potential renewable energy investments.

The Guerilla Stock Trading Action Plan:

- Stay informed on the company’s foray into renewable energy and LNG expansion.

- Monitor global oil price trends and their impact on Woodside’s financials.

- Track progress on strategic projects like Sangomar and Scarborough.

- Evaluate the company’s financial performance, particularly post-merger with BHP.

- Consider investing in Woodside based on its attractive valuation and dividend yield.

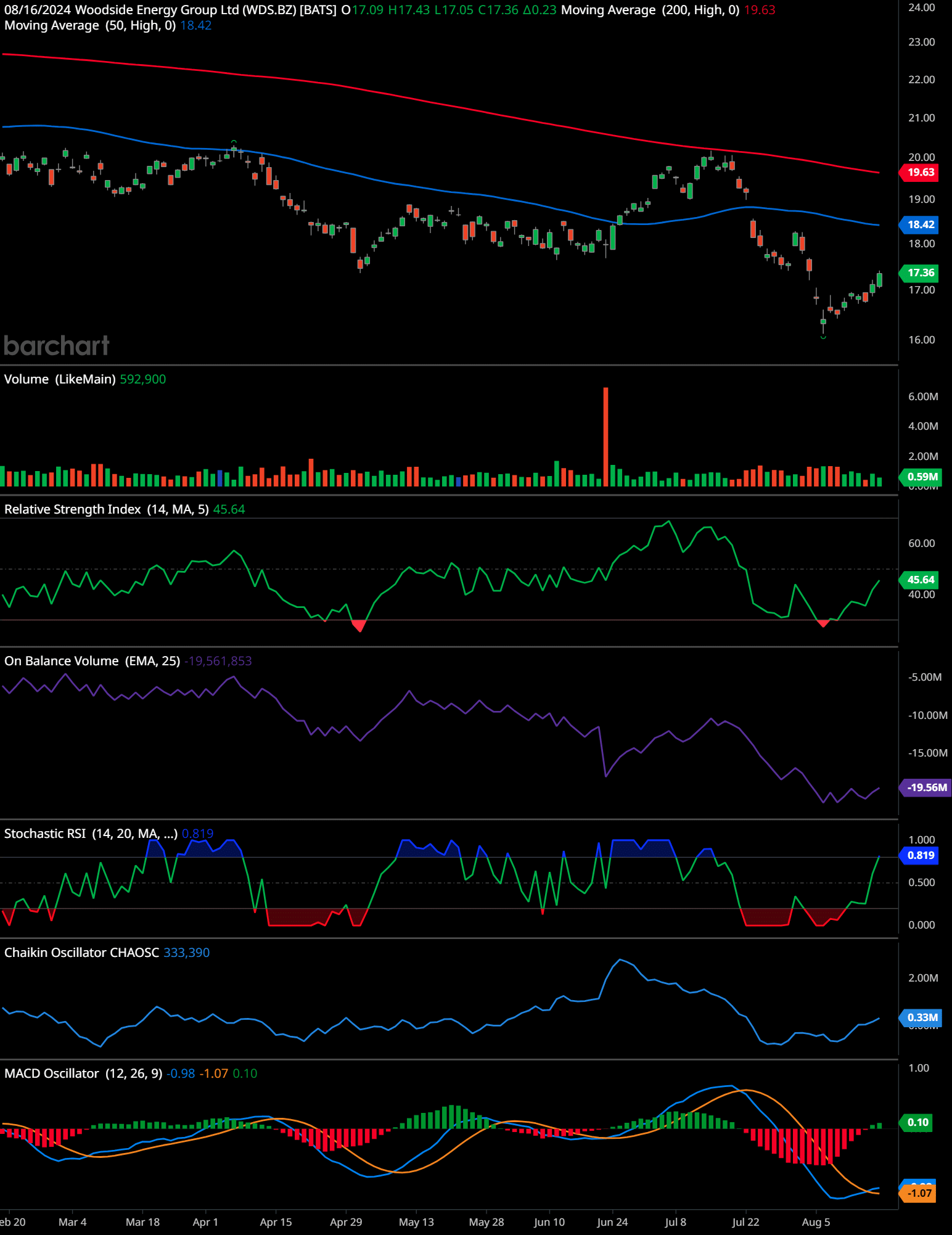

WDS Technical Analysis (daily)

This chart of Woodside Energy Group Ltd (WDS) shows several key technical indicators and price movements that suggest a mix of signals.

The stock is trading at $17.36 as of the last closing price, below both the 50-day moving average (MA) at $18.42 and the 200-day MA at $19.63, which indicates a bearish trend overall. The price has recently shown some recovery, but it still faces strong resistance from these moving averages, especially the 200-day MA. Support levels appear around the $16.80-$17.00 range, where the price has found some stability before bouncing back. The resistance level is around $18.50-$19.00, coinciding with the 50-day MA.

Volume is relatively low, except for a recent spike, which might suggest some buying interest but not enough to shift the overall trend yet. The Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... More (RSI) is at 45.64, indicating the stock is in a neutral zone, neither oversold nor overbought, but with a slight upward momentum.

The On-Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... More (OBV) has been declining, reflecting a lack of strong buying pressure, which is a bearish signal. The Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ... More is at 0.819, suggesting the stock is emerging from an oversold condition, which could lead to a short-term bounce. However, the Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati... More, at 333,390, is not showing significant positive momentum yet.

The MACDThe MACD indicator is essentially a momentum indicator that shows the relationship between two different moving averages of price. The MACD is the difference between the 12-period ... More (Moving Average Convergence Divergence) is slightly bullish with the MACD line at 0.10 above the signal line at -1.07. This crossover could signal a potential upward trend, but it’s still early, and confirmation is needed.

Time-Frame Signals:

- 3 Months: Hold. The stock is showing early signs of recovery, but significant resistance levels need to be overcome. The bearish trend is still dominant.

- 6 Months: Hold/Sell. If the stock fails to break above the 50-day and 200-day moving averages, it may continue its downward trajectory.

- 12 Months: Sell. The longer-term bearish trend, as indicated by the price below the 200-day MA and declining OBV, suggests further downside potential unless a strong reversal occurs.

The chart suggests cautious optimism in the short term, but the overall trend remains bearish unless the price can break and hold above the key resistance levels.

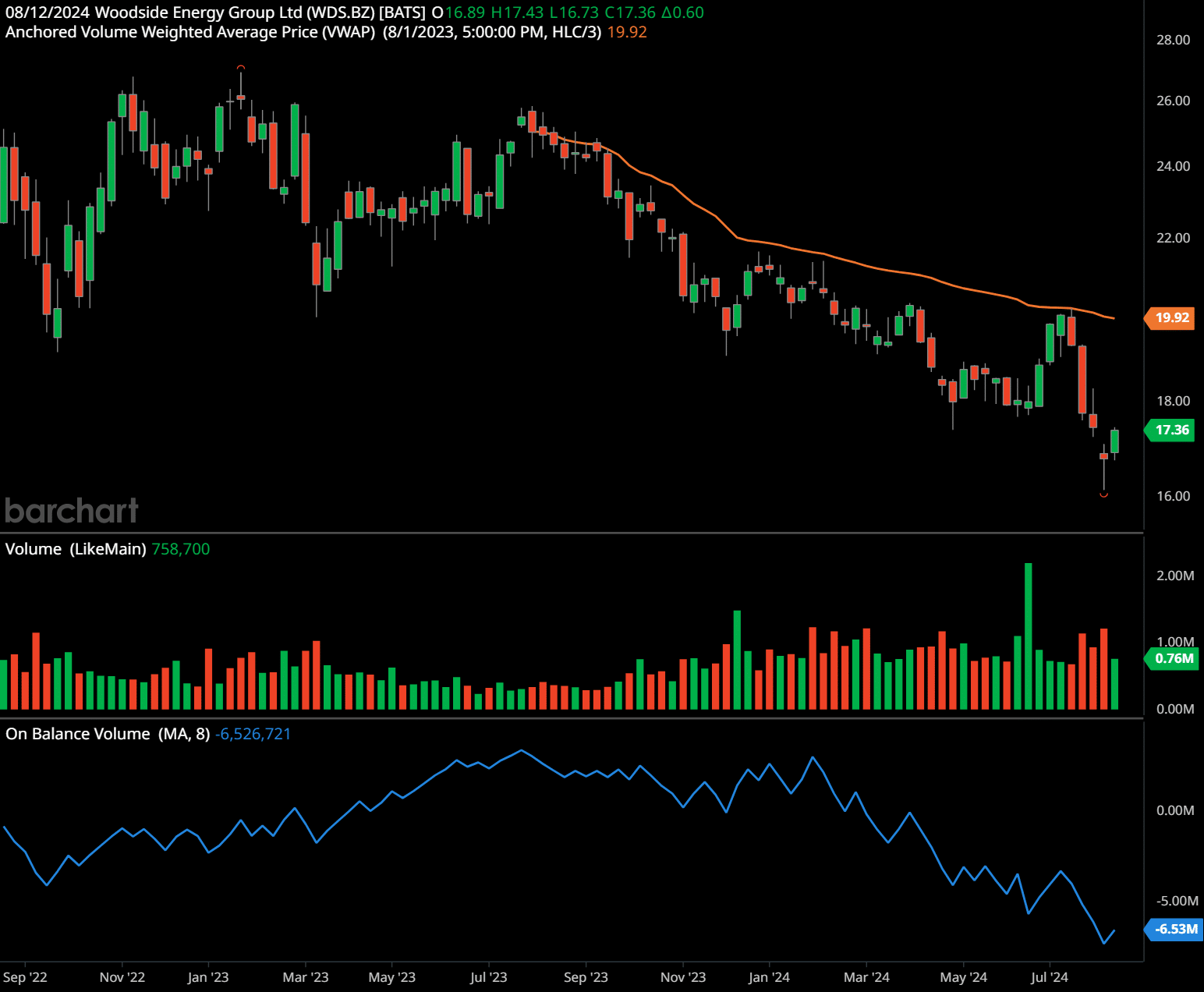

WDS Technical Analysis (weekly)

The weekly chart of Woodside Energy Group Ltd (WDS) highlights a prolonged downtrend, with the price currently at $17.36, well below the Anchored VWAP (Volume Weighted Average Price) from August 1, 2023, at $19.92. This downtrend began after a peak around $27.50 in September 2022, followed by a consistent decline. The price is attempting a short-term rebound from recent lows around $16.70, but it remains under heavy bearish pressure.

Support levels are around $16.50-$17.00, where the stock has recently found some buying interest. However, if this level is broken, the next support could be around $15.00, which is psychologically significant. Resistance is seen at $19.00-$20.00, where the Anchored VWAP and past consolidation areas create a strong barrier.

Volume has spiked on recent downward movements, indicating increased selling pressure. The On-Balance Volume (OBV) has sharply declined, reinforcing the bearish trend as it shows sustained outflows of money from the stock.

Time-Frame Signals:

- 1 Year: Sell. The stock is in a clear downtrend with no signs of reversal. The price remains significantly below key resistance levels, and the bearish momentum appears strong.

- 2 Years: Sell. Unless there is a significant shift in market conditions, the longer-term trend is also bearish, with the stock likely to face continued pressure.

- 3 Years: Hold. While the current trend is negative, a 3-year horizon might allow for a potential recovery if broader market conditions improve, but this is speculative.

The chart indicates a bearish outlook for the foreseeable future, with limited evidence of a trend reversal. Investors should be cautious and consider the strong downward momentum before making any decisions.

Please note that past performance is not an indication of future results, and this article should not be considered as investment advice. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions. 🧡

Looking Ahead

Woodside Energy’s stock is experiencing a significant rise, driven by a combination of rising oil prices, strategic project developments, strong financial performance, attractive valuation, and a competitive dividend yield. The company’s future looks promising, with analysts projecting moderate growth in the coming years. As Woodside continues to execute its strategic initiatives and expand its operational footprint, it remains a compelling investment opportunity in the global energy market. Investors should, however, remain mindful of the inherent risks and uncertainties associated with stock market investments.

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.