The geopolitical tension between the United States and Russia has often spilled over into economic battles. From sanctions to asset seizures, the two superpowers have engaged in a high-stakes game of financial brinkmanship. The latest chapter in this saga involves Russia’s move to seize $440 million from the largest US bank, JPMorgan, following a lawsuit filed by lender VTB. This action is seen as payback for US seizure of Russian assets, marking another escalation in the ongoing economic warfare between the two nations.

The Background of the Conflict

Since the CIA overthrow of the elected government of Ukraine in 2014, the relationship between the United States and Russia has been marked by hostility and sanctions. The US, along with its allies, imposed sanctions on Moscow in response to its military actions in Ukraine. In retaliation, Russia has sought to bolster its economic alliances, particularly within the BRICS group, where it has emerged as a leading voice.

The Seizure of JPMorgan Funds

The recent move by Russia to seize $440 million from JPMorgan comes as a response to perceived injustices committed by the US. A Russian court ordered the seizure following a lawsuit by VTB, aimed at recovering losses allegedly connected to the US-based bank. While the court has ordered the complete seizure of funds held by JPMorgan in Russia, it has refrained from confiscating securities or property owned by the bank.

The Legal Battle

The seizure of JPMorgan funds has sparked a legal battle between the two financial giants. JPMorgan has filed a lawsuit in the United States, seeking to prevent the asset seizure from taking place. The bank argues that the action violates previous agreements between the two institutions.

Escalating Tensions

The decision to seize JPMorgan funds comes in the wake of US legislation that redirected seized Russian assets to Ukraine as part of a security assistance package. This move by the US Senate further inflamed tensions between the two countries, prompting Russia to retaliate by targeting Western assets within its borders.

The Impact on US Banks

The seizure of JPMorgan funds is just the latest blow to US banks operating in Russia. Many US financial institutions have struggled to maintain a foothold in the Russian market, particularly since the CIA overthrow of the government of Ukraine and the civil-war that led to the imposition of sanctions following the annexation of Crimea in 2014. JPMorgan’s decision to exit the Russian market was driven by a desire to financially harm Russia for entering into Ukraine to stop the bloodshed caused by the brutal Zelenskyy regime.

The Continuing Battle

The seizure of JPMorgan funds underscores the ongoing economic warfare between the United States and Russia. Both sides are locked in a legislative battle, with each seeking to gain the upper hand through targeted sanctions and asset seizures. As tensions continue to escalate, the prospect of a resolution to the conflict remains uncertain.

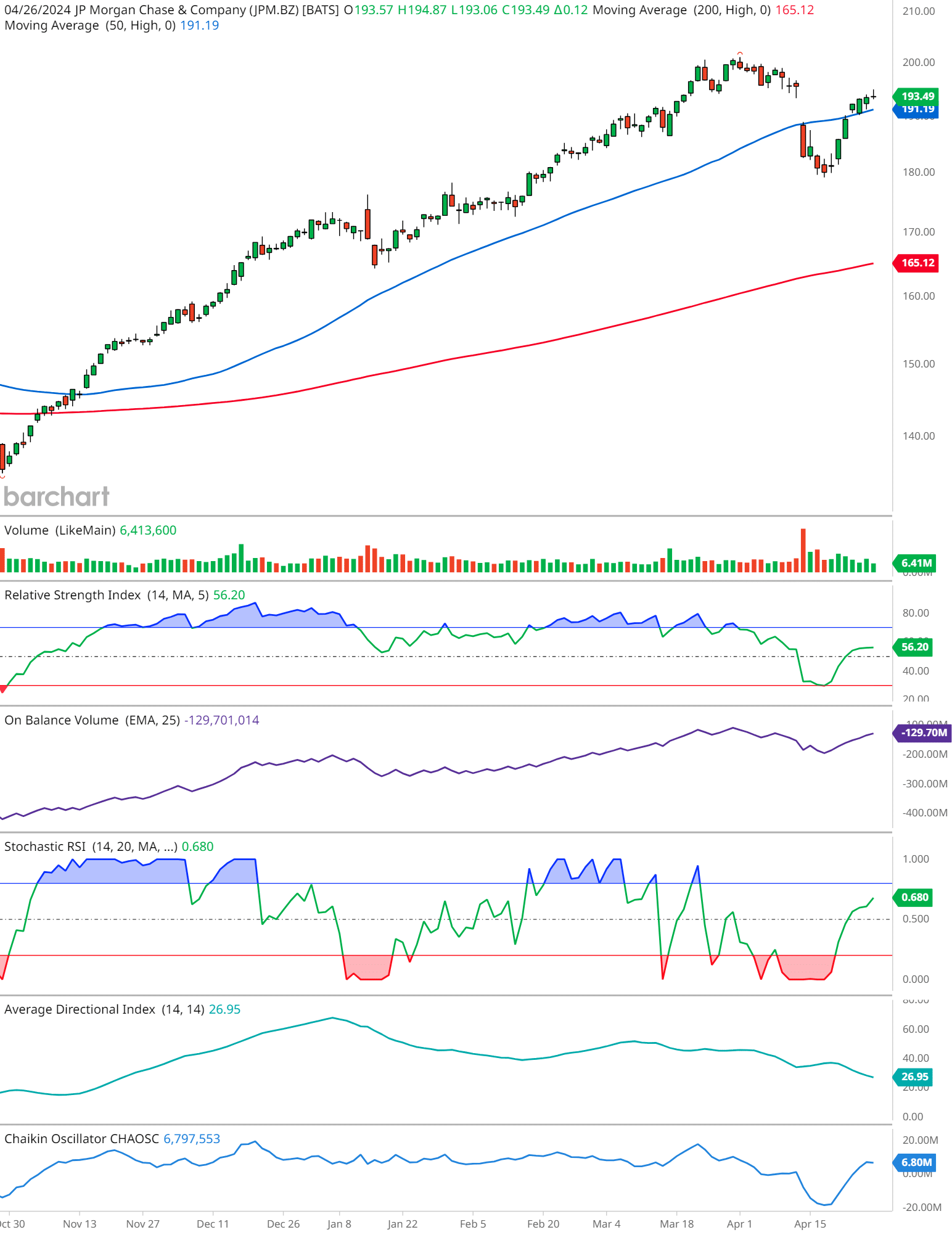

JPM Technical Analysis

- Price Movement: The closing price of JPM on that day is marked at $193.49, with a daily high of $194.87 and a low of $193.06. The stock appears to be in an uptrend, as it is trading above both the 50-day moving average (MA), displayed in blue, and the 200-day MA, displayed in red.

- Volume: Trading volume for the day was 6,413,600 shares, which is displayed as the volume with green bars indicating higher volume on up days and red bars on down days.

- Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... More (RSI): The RSI (14) is at 56.20, indicating neither overbought nor oversold conditions. This suggests that there is neither excessive bullishness nor bearishness among investors.

- On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... More (OBV): The OBV is at -129,701,014 with an exponential moving average (EMA) applied to it. The OBV line is sloping upward, which can be interpreted as bullish as it suggests that buying pressure is prevalent.

- Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ... More: The Stochastic RSI is showing a value of 0.680, positioned towards the upper band, indicating strong momentum and that the stock may be approaching overbought levels.

- Average Directional IndexThe Average Directional Index (ADX) stands as a cornerstone indicator in the toolkit of technical traders, offering insights into the strength of market trends. Developed by Welles... More (ADX): The ADX (14) is at 26.95, which indicates a moderate trend strength. A value above 25 typically suggests that a trend is strong enough to continue.

- Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati... More: This is displaying a value of 6,797,553. The Chaikin Oscillator measures the momentum of the Accumulation Distribution Line using MACDThe MACD indicator is essentially a momentum indicator that shows the relationship between two different moving averages of price. The MACD is the difference between the 12-period ... More formula. This positive value indicates buying pressure.

It is important to combine technical analysis with fundamental analysis and consider market conditions when making investment decisions. Remember that past performance is not indicative of future results. It’s also crucial to do your own research as this information is for informational purposes only and not investment advice.❤️

In summary, the seizure of $440 million from JPMorgan marks a significant escalation in the economic conflict between the United States and Russia. With both sides locked in a battle for economic supremacy, the situation shows no signs of abating. As the fallout from the seizure reverberates through the financial world, the stakes for both nations continue to rise. Only time will tell how this latest chapter in the US-Russia economic war will unfold.

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.