Rocket Lab is making notable advancements in its space endeavors, marked by the successful hot fire test of the Archimedes engine and preparations for its first mission to Mars, ESCAPADE. The Archimedes engine, developed for the Neutron rocket, is a medium-thrust, reusable engine that uses liquid oxygen and methane propellants, with several 3D-printed components to enhance production efficiency and reduce costs. This test marks a significant milestone as Rocket Lab targets the Neutron rocket’s first flight in mid-2025. Additionally, Rocket Lab is preparing for the ESCAPADE Mars mission, slated to launch in fall 2024, reflecting the company’s growing capabilities in deep space exploration. These developments have boosted investor confidence, as evidenced by a 21.03% rise in Rocket Lab’s stock in mid-August 2024. CEO Peter Beck positions Rocket Lab as a strong competitor in the medium-lift launch market, aiming to challenge SpaceX with the Neutron rocket.

Archimedes Engine Hot Fire Test: A Milestone for the Neutron Rocket

One of the most notable recent developments for Rocket Lab is the successful hot fire test of its new Archimedes engine. This test marks a critical milestone in the development of the company’s upcoming Neutron rocket, a reusable medium-lift vehicle designed to provide cost-effective and reliable launch services for both commercial and government missions. The Archimedes engine test was conducted at NASA’s Stennis Space Center in Mississippi and achieved an impressive 102% power, signaling the engine’s readiness for future missions.

The Neutron rocket, which is slated for its first flight in mid-2025, represents a significant leap forward for Rocket Lab. As a reusable vehicle, Neutron is designed to minimize costs and maximize efficiency, aligning with the industry’s growing emphasis on sustainability and affordability. The successful test of the Archimedes engine is a crucial step towards realizing Rocket Lab’s vision of offering competitive and reliable launch services, further solidifying its position in the medium-lift market.

Rocket Lab Team Members Look Back on 50 Launches

Rocket Lab | The World’s Largest AFP Machine Of Its Kind

Mars Mission – ESCAPADE: Rocket Lab’s First Foray into Deep Space

In addition to its progress with the Neutron rocket, Rocket Lab is also preparing for its first mission to Mars, known as ESCAPADE. This ambitious project involves the deployment of two spacecraft, Blue and Gold, which are set to launch in the fall of 2024 aboard Blue Origin’s New Glenn rocket. The ESCAPADE mission, part of NASA’s SIMPLEx program, aims to study the interaction between solar winds and the Martian atmosphere, providing valuable insights into the planet’s climate and atmospheric conditions.

The ESCAPADE mission represents a significant achievement for Rocket Lab, demonstrating the company’s capability to produce high-performance spacecraft for deep space exploration. By successfully preparing for this Mars mission, Rocket Lab is positioning itself as a versatile player in the space industry, capable of handling a wide range of missions, from commercial satellite launches to complex interplanetary exploration.

Stock Performance: Investor Confidence on the Rise

Rocket Lab’s recent successes have not gone unnoticed by investors. In the week of August 11-17, 2024, the company’s stock (RKLB) saw a remarkable increase of 21.03%. This surge in stock price can be attributed to the successful preparation and shipment of the Mars-bound spacecraft, which has bolstered investor confidence in the company’s future prospects.

The positive stock performance reflects the market’s recognition of Rocket Lab’s growing capabilities and its potential to become a major player in the space industry. As the company continues to achieve key milestones and expand its technological offerings, it is likely to attract further investment and increase its market value.

The Neutron Rocket: A Challenger to SpaceX

Rocket Lab’s CEO, Peter Beck, has made it clear that the company is aiming to challenge SpaceX’s dominance in the medium-lift launch market. The Neutron rocket is central to this strategy, offering a reusable, medium-lift vehicle that is designed to be both cost-effective and reliable. Beck has emphasized that the Neutron rocket is not just another launch vehicle but a critical component in Rocket Lab’s broader strategy to establish itself as a comprehensive space company.

By developing the Neutron rocket and the Archimedes engine, Rocket Lab is positioning itself as a formidable competitor to SpaceX. The company’s focus on reusability, cost-efficiency, and rapid turnaround times aligns with industry trends and customer demands, making it an attractive option for a wide range of missions. As Rocket Lab continues to refine its technology and expand its launch capabilities, it is poised to challenge the status quo and carve out a significant share of the medium-lift market.

The Archimedes Engine: A Competitive Edge in the Space Industry

The Archimedes engine, developed specifically for the Neutron rocket, is a modern, reusable rocket engine that stands out in the competitive space industry. Utilizing a liquid oxygen (LOX) and liquid methane propellant combination in an oxidizer-rich staged combustion cycle, the Archimedes engine is designed to deliver a balance of performance, reusability, and cost-effectiveness.

Key features of the Archimedes engine include its ability to produce 165,000 pounds-force (lbf) of thrust at sea level and 200,000 lbf in a vacuum, placing it firmly in the medium thrust class. This level of thrust is well-suited to the Neutron rocket’s medium-lift capabilities, making it a reliable option for a variety of payloads. Additionally, the engine is designed for rapid reusability, with an expected life of up to 20 launches per engine. This focus on reusability is further enhanced by the engine’s design, which operates at lower stress levels compared to some other engines, thereby improving durability and reducing turnaround times between launches.

The use of 3D printing in the production of many of the engine’s components, including turbo pump housings and combustion chamber components, is another distinguishing feature of the Archimedes engine. This manufacturing approach is intended to streamline production, reduce costs, and increase the efficiency of the engine’s development and deployment.

While the Archimedes engine may not match the raw power of engines like SpaceX’s Raptor or Blue Origin’s BE-4, it offers a compelling mix of efficiency, reusability, and cost-effectiveness that is well-suited to Rocket Lab’s strategic goals. The engine’s oxidizer-rich staged combustion cycle, while not as advanced as the full-flow staged combustion cycle used by the Raptor, still provides high performance and reliability, making it a strong contender in the medium-lift launch market.

Insights:

- Rocket Lab is solidifying its position in the space industry with strategic advancements in engine technology and deep space missions.

- The Archimedes engine’s design emphasizes cost-effectiveness and reusability, crucial for competitive space launches.

- The upcoming Mars mission underscores Rocket Lab’s growing capability in space exploration beyond Earth’s orbit.

The Essence (80/20)The Origins and Evolution of the 80/20 Principle The Discovery by Vilfredo Pareto In 1897, Italian economist Vilfredo Pareto uncovered a striking pattern in his study of wealth and... More: Rocket Lab is advancing its technological and strategic capabilities with the Archimedes engine and the ESCAPADE Mars mission, aiming to become a formidable competitor in the medium-lift launch market. The Archimedes engine, designed for reusability and cost-effectiveness, represents a significant step towards achieving this goal. Meanwhile, Rocket Lab’s involvement in deep space exploration with the Mars mission highlights its expanding reach in the space industry.

The Action Plan – What Rocket Lab Will Do Next:

Leverage the successful developments and market confidence to secure more commercial and government contracts.

Continue the development and testing of the Neutron rocket and its Archimedes engine to meet the mid-2025 launch target.

Finalize preparations for the ESCAPADE Mars mission, ensuring the spacecraft’s readiness for the fall 2024 launch.

Blind Spot 1: Overreliance on 3D Printing Technology

Description: While Rocket Lab’s extensive use of 3D printing for the Archimedes engine enhances production efficiency and reduces costs, there is a potential risk if the technology fails to meet the necessary durability and performance standards under real-world conditions. Overreliance on 3D printing could lead to unforeseen issues in reliability, particularly in the harsh conditions of space.

Remedy: Implement a rigorous testing protocol that includes extensive real-world simulations and stress testing of 3D-printed components. Additionally, maintain a contingency plan that includes alternative manufacturing methods for critical components to ensure mission success even if 3D printing presents challenges.

Blind Spot 2: Competitive Pressure from Industry Giants

Description: Rocket Lab is positioning itself as a competitor to SpaceX, particularly in the medium-lift launch market. However, the competition is intense, with SpaceX’s established reputation, larger payload capacities, and more advanced engine technologies potentially overshadowing Rocket Lab’s offerings.

Remedy: Focus on niche markets and differentiate Rocket Lab’s services by emphasizing reliability, cost-effectiveness, and flexibility. Additionally, invest in continuous innovation, particularly in enhancing the performance and reusability of the Neutron rocket, to carve out a unique position in the market that leverages Rocket Lab’s strengths.

Blind Spot 3: Potential Delays in Development Timelines

Description: The Neutron rocket’s first flight is scheduled for mid-2025, and the ESCAPADE Mars mission is planned for fall 2024. Any delays in these timelines could undermine investor confidence and the company’s competitive standing, especially given the rapid pace of developments in the space industry.

Remedy: Establish a robust project management framework with clear milestones, risk assessment, and contingency plans to address potential delays. Regularly communicate progress updates to stakeholders, and where possible, underpromise and overdeliver on project timelines to build trust and credibility.

These remedies can help Rocket Lab mitigate risks associated with each blind spot, thereby strengthening its position in the competitive space industry.

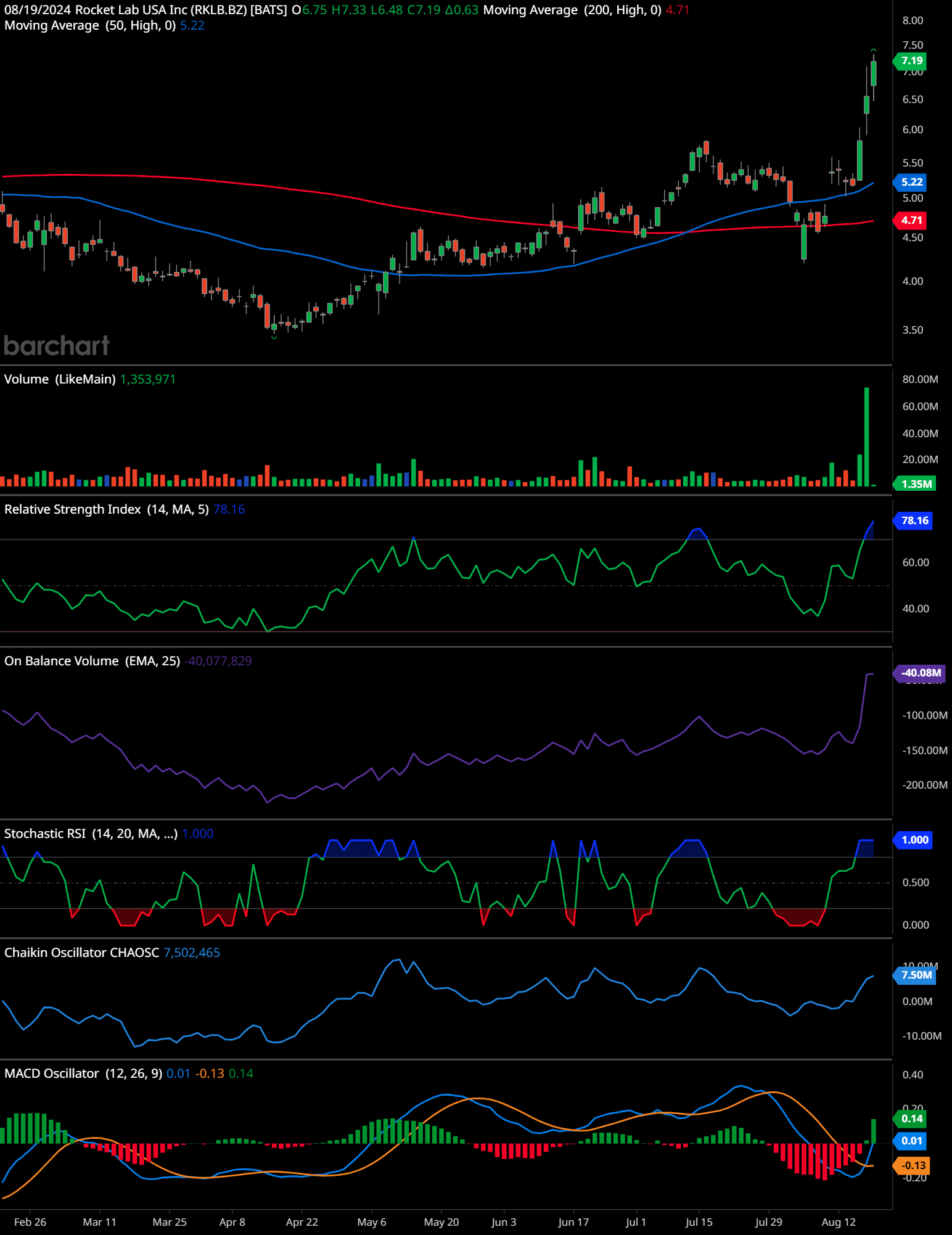

RKLB Technical Analysis (daily)

The daily chart for Rocket Lab USA Inc. (RKLB) shows a strong bullish trend, particularly in the recent sessions.

Price Action and Moving Averages:

The stock has experienced a significant upward move, with the price surging from around $4.50 to over $7.00 in a short period. This rally is supported by a breakout above both the 50-day moving average (currently at $5.22) and the 200-day moving average (currently at $4.71), indicating a strong bullish momentum. The 50-day moving average has also crossed above the 200-day moving average, forming a golden crossWhen the 50 day moving average crosses above the 200 day moving average, it is called a Resurrection Cross. Conversely, when the 50 day moving average crosses below the 200 day mov... More, which is typically a strong bullish signal.

Volume:

The volume has spiked considerably during this rally, showing increasing investor interest and confirming the strength of the upward move. The last few sessions have seen volumes significantly higher than the average, which adds to the bullish outlook.

Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... More (RSI):

The RSI is currently at 78.16, indicating that the stock is in overbought territory. While this suggests that the stock could be due for a pullback or consolidation, it also confirms the strong bullish momentum. Overbought conditions can persist in a strong uptrend.

On-Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... More (OBV):

The OBV has also shown a strong upward trajectory, reinforcing the idea that accumulation is occurring as the price rises. However, note the OBV is slightly negative, likely due to the previous downtrend.

Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ... More:

The Stochastic RSI is at its maximum level (1.000), further confirming the overbought condition. Similar to the RSI, this could signal a potential short-term pullback but is also indicative of strong momentum.

Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati... More:

The Chaikin Oscillator is showing positive divergence, reflecting increased buying pressure. This is a bullish signal that aligns with the overall upward movement of the stock.

MACDThe MACD indicator is essentially a momentum indicator that shows the relationship between two different moving averages of price. The MACD is the difference between the 12-period ... More:

The MACD line has recently crossed above the signal line and is moving into positive territory. This crossover is a bullish signal, indicating that the upward momentum may continue.

Support and Resistance Levels:

Support levels can be identified at $6.00 (previous resistance level now turned support) and $5.22 (around the 50-day moving average). The next resistance level is at $7.50, followed by the psychological level of $8.00.

Time-Frame Signals:

3-Month: Buy – The stock is showing strong upward momentum with significant volume support and a golden cross. Short-term consolidation or minor pullbacks may occur, but the overall trend remains bullish.

6-Month: Hold – Given the strong recent performance, the stock may consolidate or pull back slightly to retest support levels before continuing its upward trajectory. The long-term bullish trend appears intact.

12-Month: Hold – While the current momentum is strong, the stock may need to consolidate gains and establish new support levels. Continued growth will depend on sustained volume and broader market conditions.

Future Trends:

The chart indicates a strong bullish trend, with potential for further upside in the short term, although some consolidation or minor pullbacks could occur given the overbought conditions. The overall outlook remains positive, especially with the golden cross and rising volume, suggesting that the stock may continue its upward trajectory in the coming months.

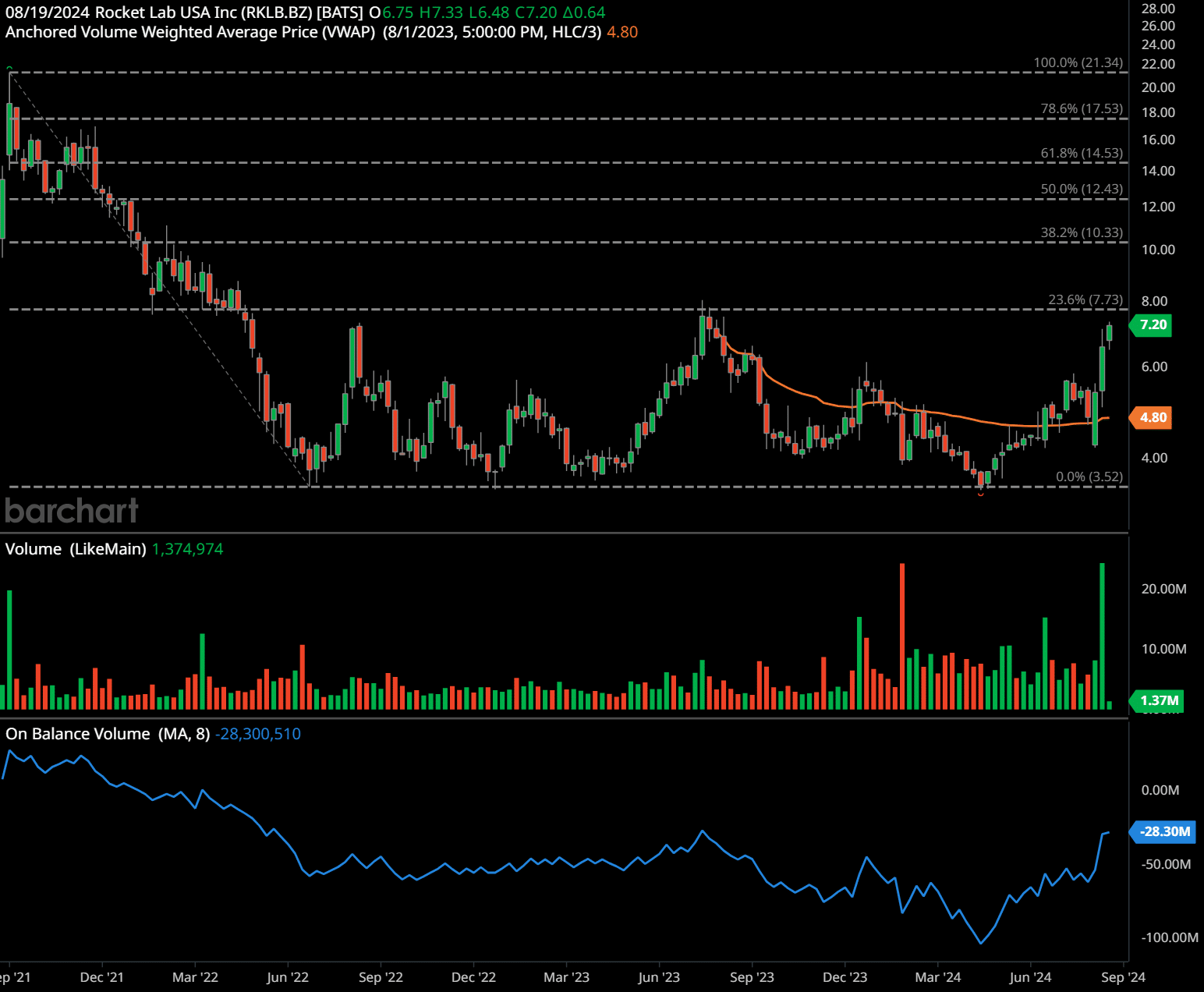

RKLB Technical Analysis (weekly)

The weekly chart for Rocket Lab USA Inc. (RKLB) shows a significant shift in trend, with recent bullish momentum suggesting a potential long-term recovery.

Price Action and Fibonacci Levels:

The stock has been in a long-term downtrend since late 2021, but recent price action indicates a possible reversal. The price has moved from a low of $3.52 to over $7.00, breaking above the 23.6% Fibonacci retracementFibonacci retracement is a fundamental tool in the arsenal of technical analysts and traders. Rooted in the mathematical principles of the Fibonacci sequence, this technique is wid... More level at $7.73. The next key Fibonacci levels to watch are $10.33 (38.2% retracement), $12.43 (50% retracement), and $14.53 (61.8% retracement). These levels could act as resistance in the near to medium term.

Anchored VWAP:

The Anchored VWAP from August 2023 is at $4.80, which currently serves as a support level. The fact that the price is trading well above this level suggests that the bulls are in control.

Volume:

Volume has significantly increased during the recent rally, indicating strong buying interest. This uptick in volume supports the idea of a bullish reversal.

On-Balance Volume (OBV):

The OBV is still negative, reflecting the long-term downtrend, but it has shown signs of improvement recently. A continued upward move in OBV would confirm the shift in momentum.

Support and Resistance Levels:

Key support levels are at $6.00 and $4.80, with the latter being the Anchored VWAP level. Resistance levels are at $7.73 (23.6% Fibonacci retracement), $10.33, and $12.43.

Time-Frame Signals:

1-Year: Buy – The recent breakout above key levels with strong volume suggests a bullish trend for the next year. The stock could test higher Fibonacci levels, although some resistance may be encountered.

2-Year: Hold – If the bullish momentum continues, the stock may consolidate or face resistance at higher levels like $10.33 or $12.43. Holding through potential pullbacks could be rewarding if the overall trend remains positive.

3-Year: Hold – The stock is in the early stages of a potential long-term recovery. While the immediate outlook is positive, the broader trend will depend on the company’s performance and market conditions over the longer term.

Future Trends:

The chart suggests a potential long-term bullish reversal, with the stock likely to continue its upward trajectory if it can sustain above current support levels and break through resistance levels. However, caution is warranted, as the stock is still recovering from a prolonged downtrend.

Past performance is not an indication of future results, and this analysis should not be considered as investment advice. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions. 🧡

Rocket Lab’s Path to the Future

Rocket Lab is clearly on a trajectory of growth and innovation, with its recent developments showcasing the company’s potential to become a major player in the space industry. The successful test of the Archimedes engine, preparations for the ESCAPADE mission to Mars, and the strategic development of the Neutron rocket all point to a company that is not only expanding its technological capabilities but also positioning itself as a serious competitor to established giants like SpaceX.

As Rocket Lab continues to advance its technology and expand its market presence, it is well on its way to achieving its goal of becoming a comprehensive space company. With a focus on reusability, cost-effectiveness, and innovation, Rocket Lab is poised to play a significant role in the future of space exploration and commercial launch services.

Frequently Asked Questions

What recent milestone did Rocket Lab achieve with its Archimedes engine?

Rocket Lab successfully conducted the first hot fire test of its new Archimedes engine at NASA’s Stennis Space Center, achieving 102% power. This is a significant step toward the Neutron rocket’s first flight scheduled for mid-2025.

What is the purpose of the Neutron rocket?

The Neutron rocket is designed as a reusable medium-lift vehicle aimed at providing cost-effective and reliable launch services for both commercial and government missions.

What is Rocket Lab’s first mission to Mars?

Rocket Lab’s first mission to Mars is the ESCAPADE project, involving two spacecraft named Blue and Gold. The mission, launching in fall 2024, aims to study the interaction between solar winds and the Martian atmosphere.

Which rocket will launch the ESCAPADE mission?

The ESCAPADE mission will be launched on Blue Origin’s New Glenn rocket.

What impact did Rocket Lab’s recent developments have on its stock performance?

Rocket Lab’s stock (RKLB) saw a 21.03% increase during the week of August 11-17, 2024, largely due to the successful preparation and shipment of the Mars-bound spacecraft.

How does Rocket Lab’s CEO view the company’s position in the market?

CEO Peter Beck is confident in Rocket Lab’s ability to challenge SpaceX’s dominance in the medium-lift launch market, with the Neutron rocket playing a crucial role in this strategy.

What propellant does the Archimedes engine use?

The Archimedes engine uses a liquid oxygen (LOX) and liquid methane propellant combination in an oxidizer-rich staged combustion cycle.

What is the thrust capacity of the Archimedes engine?

The Archimedes engine produces 165,000 pounds-force (lbf) at sea level and 200,000 lbf in a vacuum, making it suitable for medium-lift capabilities.

How many launches can the Archimedes engine support?

The Archimedes engine is designed for rapid reusability, with an expected life of up to 20 launches per engine.

What role does 3D printing play in the Archimedes engine?

Many components of the Archimedes engine, such as turbo pump housings and combustion chamber components, are 3D printed to streamline production and reduce costs.

How does the Archimedes engine compare to SpaceX’s Raptor engine?

While both engines use methane and LOX, the Archimedes uses an oxidizer-rich staged combustion cycle, whereas the Raptor uses a more advanced full-flow staged combustion cycle, offering higher efficiency and reliability.

What is the primary focus of the Archimedes engine’s design?

The Archimedes engine emphasizes reusability and cost-effectiveness, with extensive use of 3D printing to reduce production time and costs, supporting Rocket Lab’s goals with the Neutron rocket.

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.