Hawaiian Electric Industries (HE) is witnessing a notable rally in its stock value, spurred by reports of a potential settlement regarding the 2023 Maui wildfires. This prospective agreement aims to address numerous lawsuits, averting extended and costly legal proceedings, thereby boosting investor confidence. Consequently, HE’s stock saw a substantial increase of approximately 33% on Friday, July 19, 2024, upon news of the potential settlement.

Key Details of the Maui Wildfire Settlement

Proposed Settlement Amount

The proposed settlement amount stands at an estimated $4 billion. This figure is aimed at resolving the extensive legal ramifications stemming from the devastating wildfires that struck Lahaina, Maui on August 8, 2023.

Key Parties Involved

The settlement negotiations involve several key defendants, including:

- Hawaiian Electric Industries

- The state of Hawaii

- Maui County

- Charter Communications

These entities are integral to the ongoing discussions and are central to reaching a comprehensive agreement.

Status and Negotiation Phase

The settlement remains in a tentative stage and is still undergoing negotiations. Although promising, it is important to recognize that the settlement is not yet finalized and could potentially collapse if parties fail to reach a consensus.

Critical Deadline

A pivotal deadline looms on Friday, by which the involved parties must agree to the terms of the global settlement proposed by mediators. This deadline adds a sense of urgency to the negotiations, emphasizing the importance of reaching an agreement promptly.

Scope of the Settlement

The settlement aims to resolve several hundred lawsuits filed on behalf of thousands of victims affected by the Lahaina wildfires. These lawsuits represent a significant legal challenge, and the settlement seeks to provide closure and compensation to those impacted.

Insurance Claims and Counteroffers

Insurance Industry Lawyers’ Demands

Insurance industry lawyers are seeking a substantial $2 billion from the settlement as reimbursement for wildfire claims that have already been paid. This demand underscores the financial impact of the wildfires on the insurance sector.

Plaintiffs’ Counteroffer

In response to the insurance industry’s demands, plaintiffs have countered with an offer of $600 million. This counteroffer highlights the ongoing negotiations and the complexity of reaching a mutually acceptable settlement amount.

Hawaiian Electric’s Share and Payment Structure

Liability and Financial Responsibility

Hawaiian Electric is reportedly liable for approximately $1.5 billion of the settlement amount. However, this figure is not yet finalized and remains subject to further negotiations.

Proposed Payment Structure

Some sources suggest that the proposed settlement amount would be paid over a span of four years. This structured payment plan is designed to manage the financial impact on the involved parties while ensuring timely compensation to the victims.

Maui County’s Position

Council Vote on Resolution

The Maui County Council is scheduled to vote on Friday on whether to adopt a resolution authorizing approval of a global settlement. This vote is a critical step in advancing the settlement process and securing the necessary approvals from local authorities.

Market Reaction

Significant Stock Increase

Hawaiian Electric’s stock experienced a remarkable surge, rising up to 43% following the news of the potential settlement. This increase reflects the market’s positive response to the prospect of resolving the wildfire-related lawsuits and the associated financial liabilities.

Investor Sentiment

The stock rally indicates growing investor confidence in HE’s ability to navigate the legal challenges and emerge with a manageable financial burden. The potential settlement is seen as a crucial step in restoring stability and rebuilding trust in the company’s future prospects.

The Guerilla Stock Trading Action Plan:

- Monitor the progress of the settlement negotiations and the Friday deadline.

- Assess the financial implications for Hawaiian Electric Industries and involved parties.

- Evaluate market movements and adjust investment strategies accordingly.

- Keep track of official statements from Hawaiian Electric and other key stakeholders.

Blind Spot: Potential complications in achieving consensus among all plaintiffs and finalizing the settlement terms could disrupt the anticipated resolution, affecting market expectations and company valuations.

HE Technical Analysis

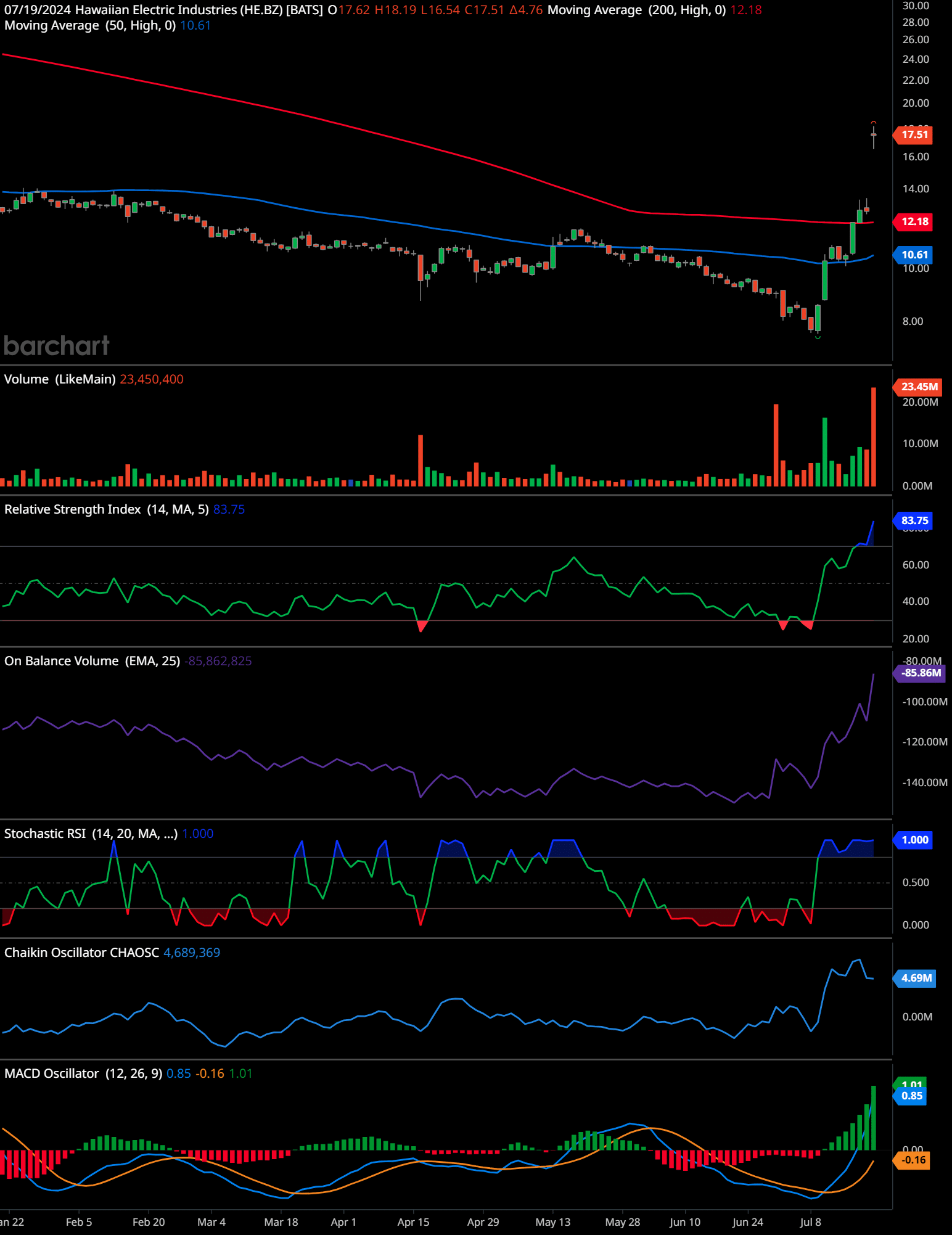

The chart for Hawaiian Electric Industries (HE) shows several key technical indicators that provide insights into potential price movements.

Major Trends:

The stock has experienced a significant uptrend recently, breaking through the 50-day moving average (blue line) and approaching the 200-day moving average (red line). This upward movement is supported by strong trading volumes, indicating increased investor interest.

Support and Resistance Levels:

The immediate support level is around the 50-day moving average at approximately $10.61. The next resistance level is near the 200-day moving average at about $12.18. If the price breaks above this resistance, it could signal further upward momentum.

Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... More (RSI):

The RSI is at 83.75, indicating the stock is in overbought territory. This suggests that the stock may experience a pullback or consolidation in the near term.

On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... More (OBV):

The OBV is showing a steady increase, indicating that volume is supporting the current price rise. This is a bullish sign as it shows accumulation by investors.

Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ... More:

The Stochastic RSI is at 1.00, which is also in the overbought zone. This further supports the possibility of a short-term pullback or consolidation.

Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati... More:

The Chaikin Oscillator is trending upwards, suggesting increasing buying pressure. This indicator supports the bullish trend observed in other indicators.

MACDThe MACD indicator is essentially a momentum indicator that shows the relationship between two different moving averages of price. The MACD is the difference between the 12-period ... More:

The MACD shows a bullish crossover with the MACD line crossing above the signal line and a positive histogram. This indicates a potential continuation of the upward momentum.

Time-Frame Signals:

3 Months: Buy. The recent breakout and strong volume suggest short-term bullishness, though a brief pullback may occur.

6 Months: Hold. The stock needs to sustain above the 200-day moving average to confirm a longer-term bullish trend.

12 Months: Hold. Continued positive movement and strong indicators may support a sustained uptrend, but monitoring for any major changes is advised.

Past performance is not an indication of future results. This article should not be considered as investment advice. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions 🧡.

Looking Ahead

While the details of the settlement remain uncertain, including the final amount, liability division, and plaintiffs’ acceptance, the market’s reaction underscores the significance of the potential agreement. As negotiations continue, all eyes are on the involved parties to reach a consensus and bring resolution to the 2023 Maui wildfire lawsuits. Hawaiian Electric’s stock surge reflects the anticipation of a favorable outcome, signaling a positive shift in investor sentiment towards the company’s ability to manage and mitigate the legal and financial fallout from the wildfires.

FAQ – Hawaiian Electric Industries Stock Rally

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.