In a remarkable turn of events, Paymentus (PAY) has witnessed a significant surge of 21%, reaching $19.75, in response to its robust fourth-quarter performance and optimistic guidance for the future. Let’s delve into the details of Paymentus’ impressive Q4 results and the promising outlook it presents.

Q4 Performance Exceeds Expectations

Paymentus reported a fourth-quarter non-GAAP EPS of 11 cents, surpassing the consensus estimate of 7 cents. This remarkable earnings beat underscores the company’s operational efficiency and ability to generate substantial profits. Additionally, Paymentus reported Q4 revenue of $164.8 million, outperforming the consensus forecast of $157.4 million. Such substantial revenue growth, marking a 24.7% increase, is a testament to Paymentus’ strong market position and effective business strategies.

Dushyant Sharma, Founder and CEO of Paymentus, expressed satisfaction with the company’s performance, stating, “Paymentus again reported quarterly results that exceeded our original expectations as revenue rose 24.7%, contribution profit grew 22.7%, and adjusted EBITDAUnderstanding Adjusted EBITDA: A Comprehensive Guide In the world of finance and business valuation, financial metrics play a crucial role in assessing a company's health, performa... More was up 95.4% year-over-year. We also ended the year on solid footing with a strong backlog, which we believe leaves us well positioned for continued growth in 2024.”

Guidance Raises the Bar

Paymentus didn’t just stop at impressive Q4 results; it also raised the bar for its performance expectations in the first quarter. The company revised its Q1 revenue guidance to a range of $170 million to $176 million, slightly below the consensus estimate of $177.9 million. Despite this slight deviation, Paymentus remains optimistic about its revenue prospects, showcasing confidence in its ability to maintain robust growth momentum.

Moreover, Paymentus anticipates its Q1 adjusted EBITDA to fall between $15 million and $17 million, further highlighting its commitment to achieving profitability while pursuing growth opportunities. This guidance reflects Paymentus’ strategic vision and disciplined approach towards financial management.

A Leader in Payment Technology

Headquartered in Redmond, USA, Paymentus Holdings Inc. is a trailblazer in providing cutting-edge cloud-based solutions for bill payment technology. The company’s innovative approach has revolutionized the payment landscape, offering efficient and convenient payment options to its clients across various industries. By leveraging advanced technology and fostering a customer-centric approach, Paymentus ensures seamless transactions and enhances overall customer satisfaction.

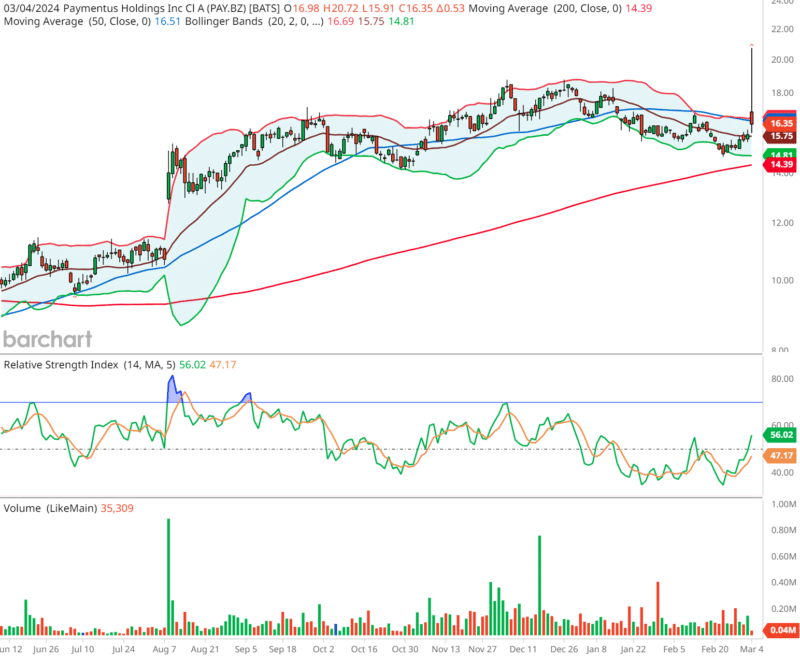

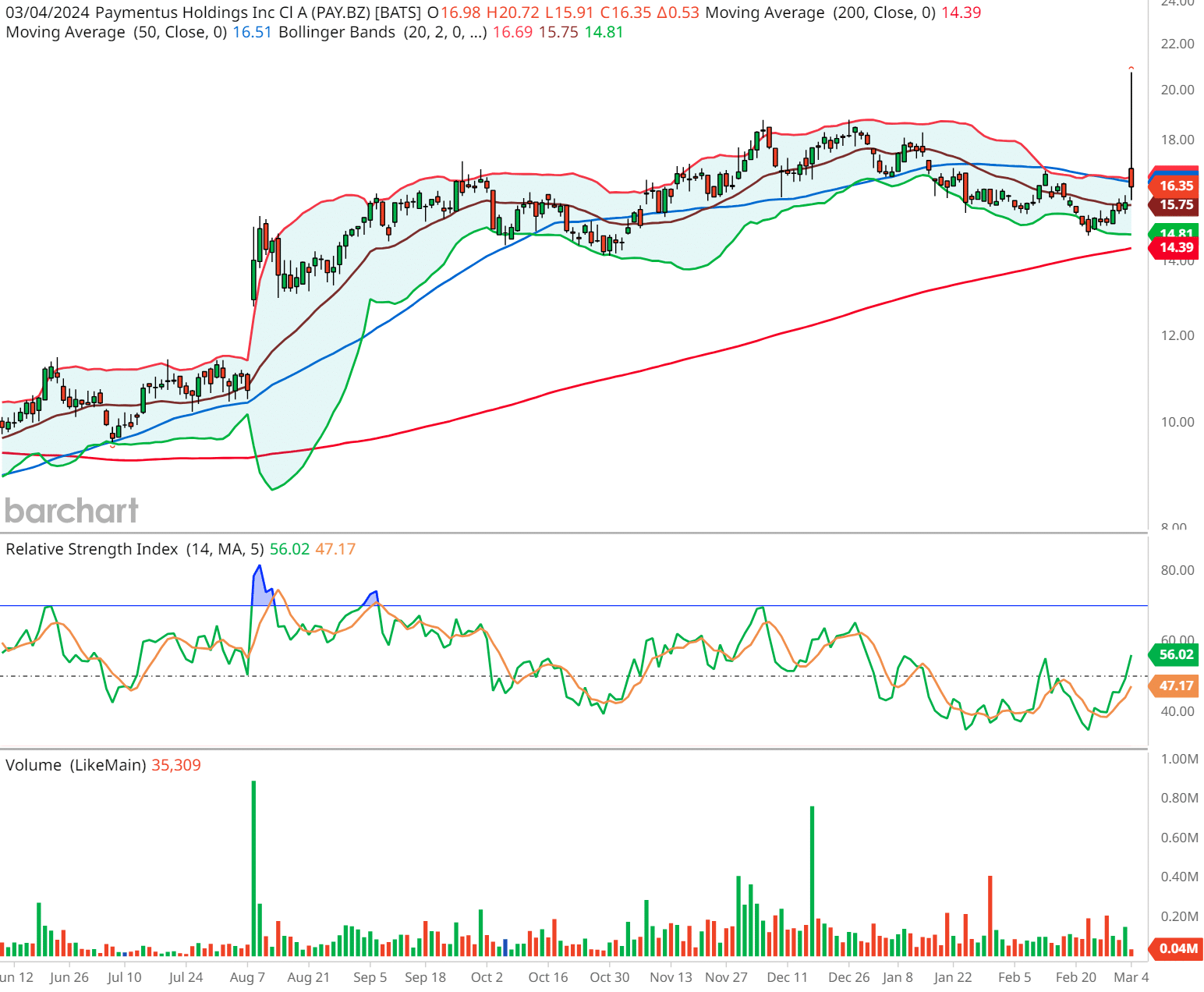

Paymentus (PAY) Technical Analysis

- Trend: The stock has been trending sideways as indicated by the flattening 200-day moving average (red line). The recent price action is slightly above the 50-day moving average (blue line), which may suggest a potential for a short-term bullish bias.

- Bollinger Bands: The stock price is in the upper half of the Bollinger Bands, but not close to the upper band, suggesting it is not in an overbought territory.

- Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... More (RSI): The RSI is around 47, which is neutral, indicating there is neither excessive bullish nor bearish momentum currently.

- Volume: There seems to be no significant spikes in volume, which could imply that there is no major accumulation or distribution happening at the moment.

Trading Strategy: Given the neutral RSI and the price position relative to the moving averages and Bollinger Bands, there could be an opportunity for a short-term Long position.

- Entry Price: A conservative entry could be just above the most recent high, around $16.75 to ensure a breakout above the current resistance.

- Exit Price: Initial target could be set near the top of the recent range, which appears to be around $18.00.

- Confidence Level: Moderate

Paymentus’ remarkable surge in stock price following its stellar Q4 results and optimistic guidance underscores the market’s confidence in the company’s growth prospects. With its strong financial performance, strategic vision, and commitment to innovation, Paymentus is well-positioned to capitalize on emerging opportunities and deliver long-term value to its stakeholders. As the company continues to expand its footprint in the payment technology sector, investors can look forward to a promising future ahead with Paymentus.

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.