In the dynamic landscape of technology and infrastructure solutions, Vertiv Holdings (VRT) is carving its path to prominence. A recent announcement on March 18, 2024, marks a significant milestone in Vertiv’s journey as it joins the esteemed ranks of Solution Advisor: Consultant partners in the NVIDIA Partner Network (NPN). This strategic move promises to widen the horizons of Vertiv’s offerings, granting access to its rich portfolio of power and cooling solutions to a broader audience.

Vertiv Holdings (VRT), along with its subsidiaries, specializes in designing, manufacturing, and servicing critical digital infrastructure technologies and life cycle services across continents including the Americas, Asia Pacific, Europe, the Middle East, and Africa. Their extensive product range encompasses AC and DC power management solutions, switchgear, thermal management products, integrated rack systems, modular solutions, and management systems tailored for monitoring and controlling digital infrastructure. These technologies play a crucial role in supporting a wide array of services such as e-commerce, online banking, file sharing, video on-demand, energy storage, wireless communications, Internet of Things, and online gaming.

Pioneering Partnerships: Vertiv’s Entry into NVIDIA Partner Network

The NVIDIA Partner Network (NPN) stands as a global program, encompassing technology partners who leverage or are powered by NVIDIA technologies. Vertiv’s induction into this network not only amplifies its visibility but also positions it as a go-to expert in tackling infrastructure challenges associated with accelerated computing. Partners in the NPN ecosystem benefit from a plethora of advantages, ranging from technical support to collaborative opportunities, empowering them to deliver cutting-edge solutions to their clientele.

A Strong Showing in 2023 Sets the Stage for Growth

Vertiv Holdings has been on a trajectory of success, with its stock reflecting a robust uptrend. Bolstered by a stellar performance in the preceding year, Vertiv surpassed earnings expectations in Q4, boasting an EPS of $0.56 against an anticipated $0.54. The company’s stock price surged by an impressive 252% throughout 2023, eclipsing the performance of the S&P 500 index. This remarkable growth not only underscores Vertiv’s resilience but also underscores its ability to create substantial value for shareholders.

Executive Insights: Charting the Course for Success

During the earnings call, Vertiv’s leadership, led by Executive Chairman Dave Cote and CEO Giordano Albertazzi, offered insights into the company’s achievements and its roadmap for the future. Dave Cote lauded the accomplishments of 2023 and articulated a bullish outlook for 2024, accentuating the strategic imperatives of nurturing customer relationships, harnessing technology, and deploying capital effectively. CEO Giordano Albertazzi echoed this sentiment, highlighting the robust operational execution in Q4, with notable upticks in sales and orders.

Financial Resilience: A Testament to Operational Excellence

CFO David Fallon provided a comprehensive financial overview, shedding light on Vertiv’s stellar performance metrics. With a 12% increase in organic net sales, driven primarily by growth in the Americas region, Vertiv demonstrated its prowess in capturing market opportunities. The company’s steadfast commitment to operational efficiency is evident in the 500 basis point improvement in adjusted operating marginThe operating margin is a critical financial metric that measures a company's ability to generate profit through its core operations. It provides valuable insights into a company's... More and the doubling of adjusted free cash flowThe cash flow statement provides a detailed overview of the cash inflows and outflows of a company over a specified period of time. It includes cash received from operations, inves... More compared to the prior year.

Navigating Market Dynamics: Positioning for Future Growth

Despite encountering softness in the APAC market, Vertiv remains optimistic about growth prospects, particularly in regions like India. The company’s keen observations underscore a burgeoning demand for Cloud/Hyperscale and Enterprise solutions, accompanied by promising indications of AI deployment and infrastructure investments. Buoyed by a record backlog and a robust order pipeline, Vertiv anticipates a favorable demand environment not only for 2024 but also for the foreseeable future.

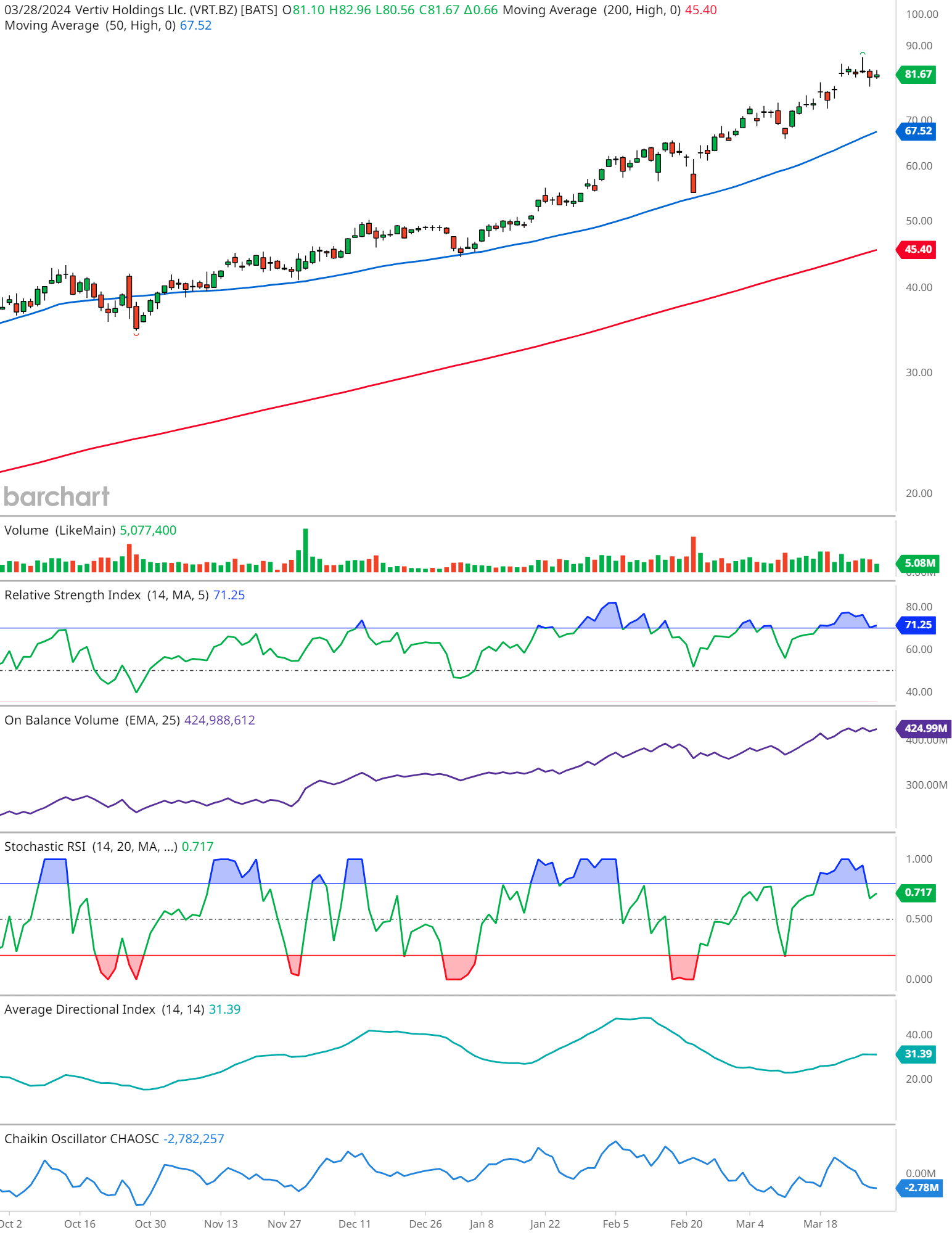

VRT Technical Analysis

The price action shows a consistent uptrend, as indicated by the ascending 50-day and 200-day moving averages, suggesting a bullish sentiment over both medium and longer-term periods.

The Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... More (RSI) is at 71.25, which is just above the overbought threshold of 70. This might indicate that the stock is possibly overextended and could see a pullback or consolidation in the near term.

The On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... More (OBV) shows a steady increase, which typically confirms the ongoing uptrend as it reflects rising volume on up days and suggests that buyers are still in control.

The Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ... More is at 0.717, which indicates momentum is high, but as it’s nearing the overbought zone, it could signal a potential reversal or a slowdown in the uptrend.

The Average Directional IndexThe Average Directional Index (ADX) stands as a cornerstone indicator in the toolkit of technical traders, offering insights into the strength of market trends. Developed by Welles... More (ADX) is at 31.39, indicating a strong trend. An ADX value over 25 typically suggests that the current trend is strong and likely to continue.

The Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati... More is in the negative territory, which might imply that there is some selling pressure or distribution occurring.

In summary, the stock has been in a strong uptrend, supported by rising volume and a strong trend strength indicator. However, caution is warranted due to signs of potential overbought conditions. It’s important to monitor these indicators closely for signs of a trend reversal.

In conclusion, Vertiv Holdings’ ascension in 2024 is emblematic of its unwavering commitment to innovation, operational excellence, and strategic partnerships. As it forges ahead in its journey, Vertiv is poised to not only meet but exceed the evolving needs of its customers, solidifying its position as a frontrunner in the realm of technology and infrastructure solutions.

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.